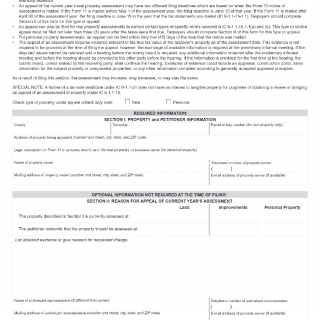

Form 130. Taxpayer's Notice to Initiate an Appeal. (Indiana)

The FORM 130 is a Taxpayer's Notice to Initiate an Appeal form in Indiana, used to appeal a final determination of the Indiana Department of Revenue. The form consists of several important fields, including the taxpayer's personal and contact information, the tax type and period, and the grounds for appeal. It is important to carefully complete all fields and attach any relevant supporting documentation, such as copies of tax returns or notices from the Department of Revenue.

The parties involved in the appeal process are the taxpayer and the Indiana Department of Revenue. The form must be submitted within 60 days of the final determination, and failure to do so may result in the loss of the right to appeal. It is recommended to consult with a tax professional or attorney before submitting the form to ensure that all necessary information is included and the appeal is properly initiated.

Strengths of the FORM 130 include its straightforward format and clear instructions, while weaknesses may include the potential complexity of the appeal process and the need for additional documentation. Opportunities for improvement may include the incorporation of online submission options and increased accessibility for non-English speakers. Threats to the use of the form may include changes in tax laws or regulations that render the form obsolete.

Related forms may include the Indiana Tax Court Petition and the Indiana Board of Tax Review Petition, which differ in their filing requirements and processes. It is important to carefully review the instructions for each form before submitting to ensure compliance with the appropriate procedures.

To fill and submit the FORM 130, the taxpayer must complete all required fields and attach any supporting documentation. The form may be submitted by mail or in person to the Indiana Department of Revenue. A copy of the form should be retained for the taxpayer's records.