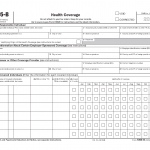

IRS Form 1095-B. Health Coverage

IRS Form 1095-B is an informational document used to report minimum essential health coverage that was provided outside the Health Insurance Marketplace.

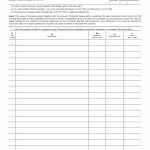

How cash, notes, and similar financial interests are reported under IRS Form 706

Cash, promissory notes, and comparable financial interests are included in the Form 706 process when the decedent held liquid assets or enforceable rights to receive payment at the time of death.

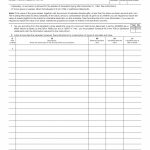

How life insurance is included in the estate under IRS Form 706

Life insurance becomes part of the Form 706 process when the decedent’s death triggers insurance proceeds that are connected to ownership rights, control, or beneficiary arrangements recognized by the estate tax system.

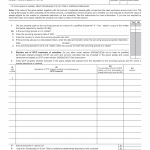

How jointly owned property is reported under IRS Form 706

Jointly owned property enters the Form 706 process when the decedent held an ownership interest in property together with another person at the time of death.

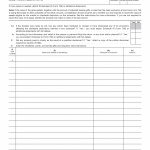

How other property interests are reported under IRS Form 706

Schedule F is used in the Form 706 process to report property interests that do not fall within the specific asset categories addressed by other schedules.

How lifetime transfers are brought back into the estate under IRS Form 706

Schedule G is used in the Form 706 process when property transferred by the decedent during life must still be evaluated as part of the estate tax system.

How powers of appointment are treated under IRS Form 706

Powers of appointment are included in the Form 706 process when the decedent held legal authority to designate who would receive certain property interests.

How annuities are included and valued under IRS Form 706

Annuities are addressed in the Form 706 process when the decedent had rights to annuity payments or benefits that continued or were triggered by death.

How the marital deduction applies under IRS Form 706

The marital deduction becomes part of the Form 706 process when property interests pass from the decedent to a surviving spouse in a manner recognized by the federal estate tax system.

How charitable and public bequests are treated under IRS Form 706

Charitable and public bequests enter the Form 706 process when property passes from the decedent to qualifying charitable, governmental, or similar organizations.