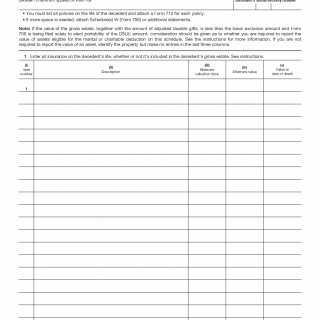

Life insurance becomes part of the Form 706 process when the decedent’s death triggers insurance proceeds that are connected to ownership rights, control, or beneficiary arrangements recognized by the estate tax system. Within federal estate taxation, life insurance is treated as a separate category because inclusion depends not only on who receives the proceeds, but on the decedent’s legal interests and powers over the policy at the time of death.

Why life insurance is reported on a separate schedule

The estate tax system isolates life insurance from other assets because proceeds may be included in the gross estate even when they are paid directly to beneficiaries. This treatment allows the Internal Revenue Service to evaluate whether the decedent retained incidents of ownership or other rights that require inclusion for estate tax purposes.

The official structure of Form 706 and the role of each schedule within that structure are defined on the IRS Form 706 document page.

When life insurance proceeds are included in the gross estate

Life insurance proceeds are included in the gross estate when the decedent owned the policy, retained incidents of ownership, or had the power to change beneficiaries or control policy benefits. Inclusion may also occur when insurance is payable to the estate or otherwise treated as an estate asset under applicable rules.

Insurance policies connected to trusts, employer arrangements, or joint ownership structures may require separate analysis to determine how the system classifies the decedent’s interest.

Valuation of life insurance for estate tax purposes

For estate tax purposes, life insurance is generally valued based on the proceeds payable by reason of death rather than the policy’s cash surrender value. This amount becomes part of the gross estate and can significantly influence the estate’s overall tax position.

Because insurance proceeds often represent substantial value, their inclusion may affect whether filing thresholds are met and how deductions and credits apply.

Interaction with deductions and estate reductions

Although life insurance increases the gross estate, related obligations or planning mechanisms may later reduce the taxable estate through deductions or exclusions applied elsewhere in the Form 706 process. These adjustments are evaluated after insurance proceeds are included as part of the estate.

The application of reductions and deductions within the system is explained in estate expenses and debts under Form 706.

How life insurance fits into the overall Form 706 process

The reporting of life insurance represents one step in the broader Form 706 filing sequence. After insurance proceeds are identified and valued, the estate continues through the remaining stages of asset integration, deduction application, and tax calculation.

The position of this step within the complete filing sequence is described in how the Form 706 filing process works, and the central overview of all Form 706 scenarios is available in the Form 706 overview.