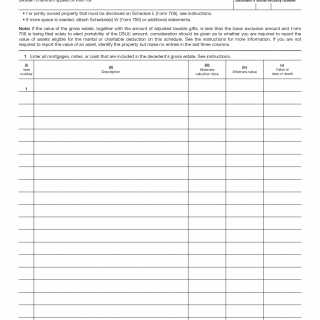

Cash, promissory notes, and comparable financial interests are included in the Form 706 process when the decedent held liquid assets or enforceable rights to receive payment at the time of death. Within the estate tax system, these items are treated as a separate asset class because they represent direct claims to value rather than ownership of property or marketable securities. Reporting these interests allows the Internal Revenue Service to determine how readily available financial value contributes to the gross estate.

Why cash and notes are reported separately

The estate tax system distinguishes cash and debt instruments from other assets because their valuation is generally straightforward, but their legal character and collectability still affect inclusion. Notes receivable, outstanding loans, and similar claims must be identified so the system can evaluate whether they represent enforceable economic benefits at death.

The formal structure of Form 706 and the role of its schedules are defined on the IRS Form 706 document page.

When these financial interests are included in the gross estate

Cash and similar assets are included in the gross estate when they were owned by the decedent or when the decedent retained the right to receive payment. This includes bank accounts, certificates of deposit, loans made by the decedent, and other notes evidencing a right to repayment.

In some situations, cash-related interests connected to jointly owned property, trusts, or lifetime transfers may be reported on different schedules depending on how the system classifies control and ownership.

Valuation and treatment within the estate

For estate tax purposes, cash is generally reported at its face value as of the date of death, while notes and similar instruments are valued based on their fair market value, taking into account collectability and applicable terms. These values flow directly into the gross estate and influence later deductions and credits.

Because these assets often interact with debts and administration expenses, their inclusion affects how the system calculates the estate’s net taxable position.

Interaction with debts, expenses, and deductions

Although cash and notes increase the gross estate, related obligations such as outstanding liabilities or expenses are applied later in the Form 706 process as reductions. The estate tax system applies these adjustments after asset classification to ensure a consistent calculation framework.

The application of these reductions is described in estate expenses and debts under Form 706.

How this schedule fits into the overall filing process

The reporting of cash and similar financial interests represents one stage in the broader Form 706 filing sequence. Once these assets are identified and valued, the estate proceeds to integrate other property categories, apply deductions, and determine the final estate tax outcome.

An overview of how this stage fits into the complete process is provided in how the Form 706 filing process works, while the central reference point for all Form 706 scenarios is available in the Form 706 overview.