IRS Form 706. United States Estate (and Generation-Skipping Transfer) Tax Return

IRS Form 706 is the federal estate tax return used to report the value of a decedent’s gross estate and to determine estate tax and generation-skipping transfer tax consequences under United States tax law.

Schedule 1 for Form 2290

Vehicle registration and renewal for heavy highway vehicles require official confirmation that federal Heavy Highway Vehicle Use Tax obligations have been satisfied for the applicable tax period.

Form 2290 practical guide

Ownership and operation of heavy highway vehicles involve federal reporting requirements that determine how each vehicle is treated under the Heavy Highway Vehicle Use Tax system.

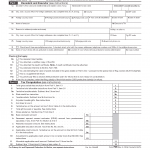

IRS Form 2290. Heavy Highway Vehicle Use Tax Return - 2022

This page describes an older version of IRS Form 2290 and is provided for reference only. The current and officially applicable version of the document is available at IRS Form 2290. Heavy Highway Vehicle Use Tax Return.

How to pay the Form 2290 tax

If Form 2290 results in a tax due, payment is required as part of the filing process, and the payment method used affects how the return is processed and when Schedule 1 becomes available.

How to file Form 2290

If you are required to file Form 2290, the way the return is submitted affects processing time, acceptance by the Internal Revenue Service, and how quickly Schedule 1 becomes available for registration or compliance purposes.

Used vehicles and mid-period purchases on Form 2290

If a heavy highway vehicle is purchased or otherwise acquired during the tax period, Form 2290 becomes relevant based on when the vehicle is first used on public highways rather than the date of purchase.

Amended Form 2290 and corrections

If information reported on Form 2290 changes after filing, or if an error is discovered, the return may no longer accurately reflect the vehicle’s tax status for the current tax period and requires correction.

Form 2290 credits and refunds

If circumstances change after Form 2290 is filed, such as a vehicle being sold, destroyed, or stolen, the Heavy Highway Vehicle Use Tax previously reported may no longer fully apply for the entire tax period, which can result in a credit or refund situation.

When Form 2290 is required

If you own or operate a heavy highway vehicle and are dealing with registration, renewal, or federal tax requirements, Form 2290 becomes relevant when the vehicle meets specific weight and highway use conditions.