How stocks and bonds are reported and valued under IRS Form 706

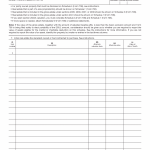

Stocks, bonds, and similar marketable securities become part of the Form 706 process when the decedent held ownership interests in publicly traded or closely held financial instruments at the time of death.

How real estate is reported and valued under IRS Form 706

Real estate becomes part of the Form 706 process when the decedent owned, or had a legally enforceable interest in, land or buildings at the time of death.

How the IRS Form 706 filing process works from start to final tax outcome

The filing of Form 706 is a structured process through which the Internal Revenue Service evaluates an estate after a decedent’s death.

When IRS Form 706 is required and why the filing obligation arises

The requirement to file Form 706 arises when a decedent’s death places the estate within the federal estate and generation-skipping transfer tax system. This obligation is not limited to situations where estate tax is ultimately due.

IRS Form 706 estate tax return overview and how the filing process works

Form 706 is used when a decedent’s estate must be evaluated under the federal estate and generation-skipping transfer tax system, either because the value of the estate exceeds statutory thresholds or because the filing is required to preserve specific tax positions such as portability.

How IRS Form 706 applies to prior years and earlier dates of death

Form 706 may be required or permitted for estates connected to dates of death in earlier years when the estate tax system applies rules, thresholds, and exemptions that were in effect at that time.

How to amend a previously filed IRS Form 706 and why corrections occur

An amended Form 706 becomes necessary when information reported on the original estate tax return changes or proves incomplete after filing.

How the generation-skipping transfer tax applies within IRS Form 706

The generation-skipping transfer tax becomes relevant in the Form 706 process when property transfers skip a generation, such as transfers to grandchildren or certain trusts.

How special exclusions and credits modify the estate tax outcome under IRS Form 706

Special exclusions and credits apply within the Form 706 process when statutory provisions adjust the estate tax result beyond standard deductions.

How debts and administration expenses reduce the estate under IRS Form 706

After property included in the gross estate is identified and valued, the Form 706 process applies reductions for obligations that legally diminish the estate’s taxable value.