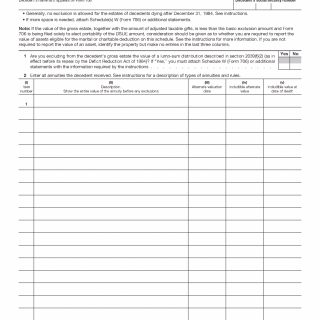

Annuities are addressed in the Form 706 process when the decedent had rights to annuity payments or benefits that continued or were triggered by death. Within the estate tax system, annuities are treated as a distinct category because inclusion depends on contractual rights, survivor benefits, and the extent to which the decedent retained an enforceable interest at the time of death.

Why annuities are reported on a separate schedule

The estate tax system evaluates annuities separately because they often involve ongoing payment obligations rather than ownership of a fixed asset. Inclusion depends on the terms of the annuity contract and whether the decedent retained the right to receive payments or control beneficiary designations.

The official structure of Form 706 and the placement of each schedule within the return are defined on the IRS Form 706 document page.

When annuity interests are included in the gross estate

Annuity interests are included in the gross estate when the decedent retained the right to receive payments for life, had the power to affect survivorship benefits, or otherwise held contractual rights that continued at death. Annuities payable solely to another person without retained rights may be excluded depending on how the system classifies the interest.

The analysis focuses on the nature of the decedent’s rights under the annuity contract rather than on the payment stream itself.

Valuation of annuities for estate tax purposes

For estate tax purposes, annuity interests are valued based on actuarial calculations that reflect expected future payments, applicable mortality assumptions, and contractual terms. This valuation establishes the amount included in the gross estate and affects subsequent deductions and credits.

Because annuities can represent substantial future value, their inclusion may influence the estate’s overall tax position.

Interaction with deductions and later stages

Property included through annuity interests may later qualify for deductions or exclusions depending on how the benefits are structured and who ultimately receives them. These adjustments are applied at later stages of the Form 706 process.

The application of deductions and exclusions is explained in how the Form 706 filing process works.

How this schedule fits into the overall Form 706 process

The reporting of annuities represents one step in the broader Form 706 filing sequence. After annuity interests are identified and valued, the estate proceeds through the remaining stages of asset integration, deduction application, and tax calculation.

The central overview for all Form 706-related scenarios is available in the Form 706 overview.