The marital deduction becomes part of the Form 706 process when property interests pass from the decedent to a surviving spouse in a manner recognized by the federal estate tax system. This deduction reflects the system’s treatment of spousal transfers as deferred rather than immediately taxable, allowing property to move to the surviving spouse without estate tax at the first death when statutory conditions are met.

Why transfers to a surviving spouse are treated differently

The estate tax system distinguishes spousal transfers because it views married couples as a single economic unit over time. Property passing to a surviving spouse is therefore evaluated under special rules that determine whether the transfer qualifies for the marital deduction or must be included in the taxable estate.

The official structure of Form 706 and the statutory role of each schedule are described on the IRS Form 706 document page.

When property qualifies for the marital deduction

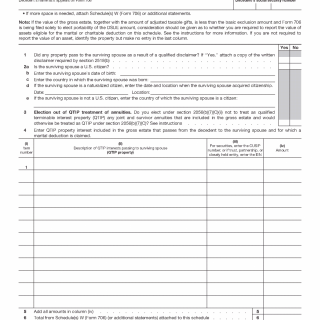

Property generally qualifies for the marital deduction when it passes outright to a surviving spouse who is a United States citizen. Certain terminable interests may also qualify when specific elections are made and reporting requirements are satisfied as part of the Form 706 process.

The determination focuses on the nature of the interest received by the surviving spouse and the conditions attached to that interest.

Qualified terminable interest property and elections

Some spousal transfers involve interests that terminate at a later time, such as life estates or income interests. These transfers may qualify for the marital deduction only when the estate makes specific elections and reports the property in a prescribed manner. Once made, these elections affect how the property is treated for both estate and generation-skipping transfer tax purposes.

The interaction between marital deduction elections and later tax consequences is part of the broader Form 706 filing sequence.

Interaction with portability and future tax consequences

The marital deduction directly affects whether unused exclusion amounts remain available for transfer to the surviving spouse. When property qualifies for the deduction, it may reduce current estate tax while preserving exclusions that can be carried forward through portability.

The relationship between the marital deduction and preserved exclusion amounts is part of the overall system described in how the Form 706 filing process works.

How this schedule fits into the overall Form 706 process

The reporting of spousal transfers represents a key stage in the Form 706 filing sequence. Once qualifying property is identified and elections are made, the estate proceeds to apply remaining deductions, exclusions, and tax calculations.

The central reference point for all Form 706-related scenarios is available in the Form 706 overview.