What to do if Form 2290 mileage limits are exceeded

If a vehicle reported as suspended on Form 2290 ends up being used more than the allowed mileage during the tax period, the suspension no longer applies and the Heavy Highway Vehicle Use Tax becomes due.

Form 2290 suspension rules

If a heavy highway vehicle is expected to be used only a limited number of miles during the tax period, Form 2290 allows it to be reported as suspended from the Heavy Highway Vehicle Use Tax under specific mileage conditions.

Form 2290 due dates and tax period

If you are responsible for filing Form 2290, the timing of the return becomes critical because the Heavy Highway Vehicle Use Tax follows a fixed annual period and specific filing deadlines tied to when a vehicle is first used on public highways.

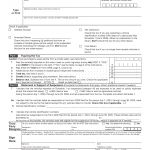

IRS Form 2290. Heavy Highway Vehicle Use Tax Return

IRS Form 2290 is the official federal tax return used to report and pay the Heavy Highway Vehicle Use Tax for certain heavy vehicles operated on public highways during the applicable tax period.

Common Mistakes When Responding to IRS Letter 4883C

When responding to IRS Letter 4883C, certain mistakes can delay identity verification and extend the time it takes for the Internal Revenue Service to process a tax return. Understanding these common issues helps taxpayers avoid unnecessary delays.

What Happens After Identity Verification for IRS Letter 4883C

After you successfully complete identity verification for IRS Letter 4883C, the Internal Revenue Service resumes processing your tax return. Verification confirms that the return was filed by the correct taxpayer and allows the IRS to move forward.

What Happens If You Ignore IRS Letter 4883C

Ignoring IRS Letter 4883C means that the Internal Revenue Service will not continue processing your tax return until your identity is verified. The letter is not optional, and no action by the IRS will move forward without completing the required verification.

IRS Letter 4883C Response Deadline

IRS Letter 4883C includes a timeframe for completing identity verification, and responding promptly is essential to avoid extended delays in tax return processing.

What Information the IRS Asks for With Letter 4883C

When responding to IRS Letter 4883C, the Internal Revenue Service asks for specific personal and tax-related information to verify your identity. This information is used only to confirm that the tax return was filed by the correct taxpayer and to prevent identity theft.

Online vs Phone Identity Verification for IRS Letter 4883C

When responding to IRS Letter 4883C, identity verification may be completed either online or by phone, depending on the options provided in the letter. The IRS determines which methods are available based on the information needed to confirm the taxpayer’s identity.