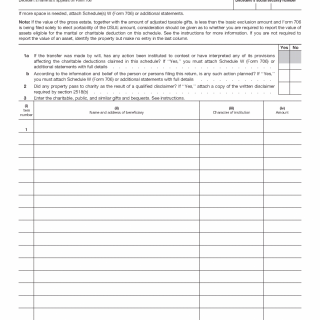

Charitable and public bequests enter the Form 706 process when property passes from the decedent to qualifying charitable, governmental, or similar organizations. Within the federal estate tax system, these transfers are treated separately because they are removed from taxation when statutory conditions are satisfied, reflecting the system’s policy of encouraging certain public-benefit transfers.

Why charitable bequests are evaluated separately

The estate tax system distinguishes charitable and public transfers from other dispositions because qualifying organizations are exempt recipients under federal tax law. Property passing to such organizations does not represent taxable wealth transfer in the same way as transfers to individuals.

The official structure of Form 706 and the statutory role of its schedules are described on the IRS Form 706 document page.

When property qualifies for the charitable deduction

Property qualifies for the charitable deduction when it passes to organizations that meet statutory definitions and when the transfer is structured so that the interest received is deductible under estate tax rules. The analysis focuses on the character of the recipient organization and the nature of the interest transferred.

Transfers subject to conditions, disputes, or future contingencies are evaluated carefully to determine whether and when the deduction applies.

Valuation of charitable bequests

For estate tax purposes, charitable bequests are valued based on the fair market value of the property interest transferred. When the transfer involves split interests or future interests, valuation reflects the portion of the property that qualifies for the deduction.

The value allowed as a deduction directly reduces the taxable estate and may eliminate estate tax liability.

Interaction with other deductions and estate calculations

Charitable deductions are applied after the gross estate is determined and after reductions for debts and expenses. This sequencing ensures that the deduction reflects the true value of property available for charitable transfer.

The interaction of deductions within the overall filing sequence is explained in how the Form 706 filing process works.

How this schedule fits into the overall Form 706 process

The reporting of charitable and public bequests represents a distinct stage in the Form 706 filing sequence. Once qualifying transfers are identified and valued, the estate proceeds to complete remaining deductions, exclusions, and tax calculations.

The central overview for all Form 706-related scenarios is available in the Form 706 overview.