Schedule G is used in the Form 706 process when property transferred by the decedent during life must still be evaluated as part of the estate tax system. These transfers are included not because the property remained owned at death, but because federal estate tax rules treat certain lifetime transactions as continuing to affect the decedent’s taxable estate.

Why lifetime transfers are reviewed after death

The estate tax system evaluates not only what the decedent owned at death, but also whether prior transfers reduced ownership in a way that triggers statutory inclusion. Certain transfers are examined to determine whether the decedent retained control, enjoyment, or economic benefit that requires the property to be brought back into the estate for tax purposes.

The formal structure of Form 706 and the placement of each schedule within the return are defined on the IRS Form 706 document page.

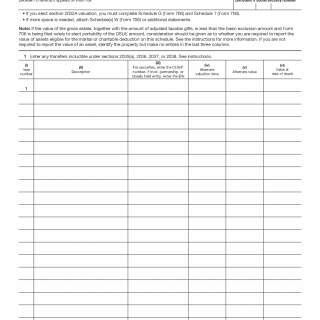

Types of transfers commonly reported on this schedule

Schedule G commonly includes transfers with retained life estates, revocable transfers, and other arrangements where the decedent continued to benefit from or control the property. These situations reflect the system’s focus on substance over form when evaluating lifetime transactions.

Transfers involving trusts, business arrangements, or contractual rights may also be reviewed under this schedule when the estate tax rules require inclusion.

Valuation of lifetime transfers

For estate tax purposes, property brought back into the estate through lifetime transfer rules is valued based on its fair market value at the date of death or an alternate valuation date when permitted. This valuation reflects the system’s treatment of the property as if it were still owned at death.

The value included through this process directly affects the gross estate and influences subsequent deductions, credits, and exclusions.

Interaction with deductions and later stages

Although lifetime transfers increase the gross estate when included, related deductions or expenses may later reduce the taxable estate through other stages of the Form 706 process. These adjustments are applied after inclusion to maintain a consistent calculation framework.

The application of these reductions is described in estate expenses and debts under Form 706.

How this schedule fits into the overall filing process

The reporting of lifetime transfers represents one stage in the broader Form 706 filing sequence. Once these transfers are identified and valued, the estate continues through the remaining steps of asset integration, deduction application, and tax calculation.

An overview of how this stage fits into the complete process is provided in how the Form 706 filing process works, while the central reference point for all Form 706-related scenarios is available in the Form 706 overview.