Jointly owned property enters the Form 706 process when the decedent held an ownership interest in property together with another person at the time of death. Within the estate tax system, jointly owned assets are treated separately because inclusion depends on how ownership was structured, how consideration was provided, and whether survivorship rights transfer property automatically upon death.

Why jointly owned property is evaluated separately

The estate tax system distinguishes jointly owned property to determine what portion of the asset is attributable to the decedent. Unlike individually owned assets, joint property may shift ownership by operation of law at death, requiring the system to analyze contribution, control, and statutory inclusion rules.

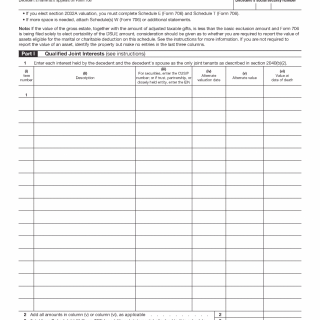

The formal structure of Form 706 and the placement of each schedule within the return are defined on the IRS Form 706 document page.

When jointly owned property is included in the gross estate

Jointly owned property is included in the gross estate to the extent required by estate tax rules that measure the decedent’s contribution or retained interest. In many cases, the full value of the property is included unless the surviving co-owner can demonstrate that part of the property was acquired with independent consideration.

Different ownership forms, such as joint tenancy with right of survivorship or tenancy by the entirety, are evaluated based on how the system attributes ownership at death.

Valuation of jointly owned property

For estate tax purposes, jointly owned property is valued based on its fair market value at the date of death or an alternate valuation date when permitted. The value included in the estate reflects the portion attributed to the decedent under applicable rules.

This valuation becomes part of the gross estate and affects later deductions, exclusions, and tax calculations.

Interaction with deductions and estate reductions

Property included through joint ownership may be subject to mortgages, liens, or administration expenses that reduce the estate at later stages of the Form 706 process. These reductions are applied after the property’s value has been included in the gross estate.

The treatment of these reductions is explained in estate expenses and debts under Form 706.

How this schedule fits into the overall filing process

The reporting of jointly owned property represents one step in the broader Form 706 filing sequence. Once the appropriate portion of the property is included, the estate proceeds through the remaining stages of asset integration and tax calculation.

An overview of how this stage fits into the complete process is provided in how the Form 706 filing process works, while the central reference point for all related scenarios is available in the Form 706 overview.