Form DTF-5. Statement of Financial Condition

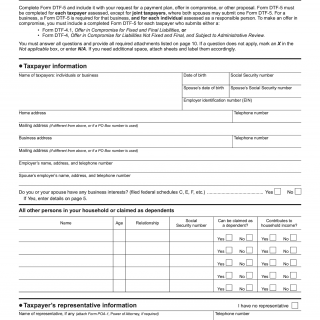

Form DTF-5 is a Statement of Financial Condition used by taxpayers in the state of New York who are making a request for a payment plan, offer in compromise, or other proposal. This form must be completed for each taxpayer assessed, except for joint taxpayers who may submit one form together.

The form consists of several sections, including personal information about the taxpayer, details on income and expenses, assets and liabilities, and other financial information. It is important to answer all questions and attach any required documentation listed on page 10 of the form.

Parties involved in this process include the taxpayer and the New York State Department of Taxation and Finance. The purpose of this form is to provide a detailed overview of the taxpayer's financial situation and help determine eligibility for various payment options.

Data required when filling out this form includes personal information such as name, address, social security number, and contact information. Additional information such as income, expenses, assets, and liabilities will also be required. Documents that must be attached include tax returns, bank statements, and payroll records.

Examples of when this form might be needed include when a taxpayer is unable to pay their taxes in full and needs to negotiate a payment plan or make an offer in compromise. Strengths of this form include its comprehensive nature, which allows for a thorough review of the taxpayer's financial situation. Weaknesses could include potential delays or complications if inaccurate information is provided.

Analogues of this form may include similar financial statement forms used by other government agencies or financial institutions. Differences between these forms might include variations in required information, formatting, and terminology.

Overall, the completion of Form DTF-5 plays a critical role in determining appropriate payment options for taxpayers who are struggling to meet their tax obligations. The form is submitted to the New York State Department of Taxation and Finance and stored in their records for future reference.