Form HSMV 85921. International Fuel Tax Agreement, Florida Tax Return - Florida

Form HSMV 85921 is used in Florida for motor carriers to report and remit their fuel taxes under the International Fuel Tax Agreement (IFTA). This form serves as the tax return specifically for carriers registered under IFTA in Florida.

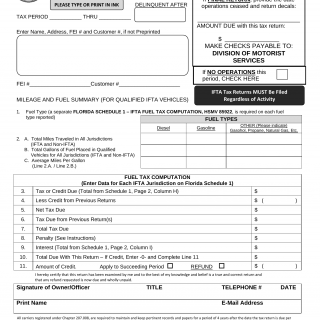

The form consists of sections and important fields, including:

- Carrier Information: This section requires details about the motor carrier, such as their legal name, address, identification numbers, and any applicable contact information.

- Fuel Usage and Mileage: Here, the carrier provides detailed information regarding their fuel usage and mileage within Florida and other participating jurisdictions. They need to report the number of gallons of fuel consumed and the distance traveled in each jurisdiction.

- Tax Calculation: The form includes fields where the carrier calculates the total tax due based on the reported fuel usage and mileage. The applicable tax rates for each jurisdiction are considered in the calculation.

- Payment Details: The carrier provides information on the payment method and includes the amount to be remitted as fuel tax payment.

- Signature: The authorized representative of the motor carrier signs the form, verifying the accuracy of the information provided and acknowledging the tax liability.

When filling out this form, it is important for the motor carrier to accurately report their fuel usage and mileage in each jurisdiction to calculate the correct tax liability. They must also ensure that the payment details are correctly filled out, including the amount to be remitted.

An alternative form related to this is Form HSMV 85900, which is the IRP Trip Report and Mileage Record - Florida. While Form HSMV 85921 specifically relates to reporting fuel taxes under the IFTA, Form HSMV 85900 is used to record trip details and mileage for vehicles registered under the International Registration Plan (IRP).