Form FTB-3804. Pass-Through Entity Elective Tax Calculations

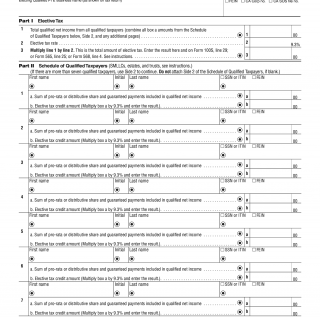

The FTB-3804 form is used for Pass-Through Entity Elective Tax Calculations in California. The main purpose of this form is to calculate the tax owed on income earned by pass-through entities such as partnerships, LLCs, and S corporations.

The form consists of several parts including Part I which requires general information about the entity and its partners or members, and Part II which calculates the elective tax due. Important fields on the form include the taxable year, FEIN, and the total income earned by the pass-through entity.

Parties involved in filling out the form include the pass-through entity and its partners or members. It is important to consider the tax implications and requirements when filling out the form, as incorrect information could result in penalties or legal issues.

Data required when filling out the form includes the pass-through entity’s income and deductions, and any information about the partners or members. In addition to the form, certain schedules may need to be attached depending on the specific circumstances of the entity.

Examples of practice and use cases for the FTB-3804 form include partnerships, LLCs, and S corporations who are electing to pay the elective tax instead of having their partners or members pay individual taxes on the entity’s income.

Strengths of the form include its ability to simplify tax calculations for pass-through entities, while weaknesses could include its complexity and potential for errors. Opportunities could include streamlining the process even further, while threats could include changes to tax laws that affect pass-through entities.

Related forms include the federal tax form 1065, which is used for partnership income tax returns, and the California tax form 568, which is used for limited liability company tax returns.

Filling out the FTB-3804 form can affect the future of the participants by ensuring compliance with tax laws and potentially reducing tax liability. The form is typically submitted electronically through the California Franchise Tax Board website, and is stored electronically in their records.