Form DTF-275. Identity Theft Declaration

The DTF-275 Identity Theft Declaration is a form issued by the New York State Department of Taxation and Finance to help taxpayers report fraudulent use of their personal identification information for tax purposes. The primary purpose of this form is to enable taxpayers to report suspected identity theft and protect themselves from potential financial loss.

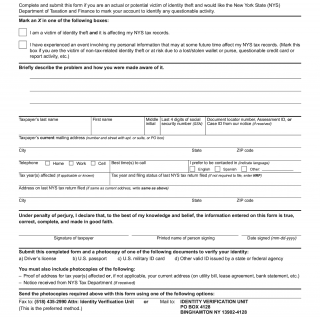

The form consists of several sections that require detailed information about the taxpayer, including their name, social security number, address, and contact information. It also requires a description of the suspected fraud and any actions taken by the taxpayer to resolve the issue. Additionally, the form may require additional documents to be attached, such as copies of police reports or credit monitoring statements.

This form is important for individuals who believe they have fallen victim to identity theft and want to take immediate action to prevent further harm. By filing this declaration, taxpayers are alerting the authorities of any fraudulent activity and taking steps to safeguard their finances.

One strength of this form is that it provides a clear and straightforward process for taxpayers to report identity theft, which can be a complex and confusing issue. However, one weakness is that it may not provide enough guidance for individuals who are unfamiliar with the reporting process.

There are no alternative or analogous forms for reporting identity theft to the New York State Department of Taxation and Finance. This form is unique to this agency and is specifically designed to meet their requirements.

Once completed, the form can be submitted electronically or by mail to the department. The form and any accompanying documents will be stored securely by the department and used for investigation and resolution of the reported fraud.

In summary, the DTF-275 Identity Theft Declaration is an important tool for individuals who suspect their personal information has been stolen and used for tax purposes. By completing this form, taxpayers can take control of their finances and protect themselves from further harm.