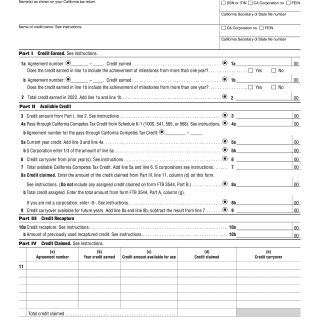

Form FTB-3531. California Competes Tax Credit

FTB-3531 is a California Competes Tax Credit form that businesses can use to apply for the California Competes Tax Credit program. The purpose of this program is to encourage businesses to come, stay, and grow in California by offering tax credits to companies that create jobs and make capital investments in the state.

The form consists of several parts, including general information about the business, a summary of the proposed project, the number of employees the project will create, and the amount of investment the project will require. The form also includes questions about the business's history and experience, as well as its financial standing and tax compliance.

Important fields on the form include the legal name of the business, its address, and contact information. Other essential fields include the proposed start date of the project, the number of jobs the project will create, and the estimated investment required. The parties involved are the business applying for the tax credit and the California Governor's Office of Business and Economic Development, which reviews and approves the applications.

When filling out the form, businesses need to provide specific data, such as their NAICS code, industry sector, and detailed information on the proposed project. Additionally, companies must attach supporting documents like resumes of key personnel, pro forma financial statements, and evidence of compliance with California tax laws.

Examples of practice and use cases for this form would be a company looking to expand its operations in California or establishing a new facility in the state. By receiving the tax credit, businesses can reduce their tax liability and invest more into growing their companies.

Strengths of this form include the availability of up to $180 million in tax credits, while weaknesses may include the competitive nature of the application process, making it difficult for some companies to secure funding. Opportunities include encouraging economic growth in California, while threats may include businesses relocating to other states with more favorable tax incentives.

Alternative forms that may be used include the California Competes Tax Credit Application, which is a similar form that requires much of the same information. However, the FTB-3531 form is specific to businesses filing for tax credits under this program.

The submission process for this form involves mailing it to the Governor's Office of Business and Economic Development. Once approved, the tax credit will be applied to the business's California state income tax return for the year in which the project began.

Overall, the FTB-3531 form plays an essential role in encouraging economic growth in California by offering tax credits to businesses that create jobs and make investments in the state.