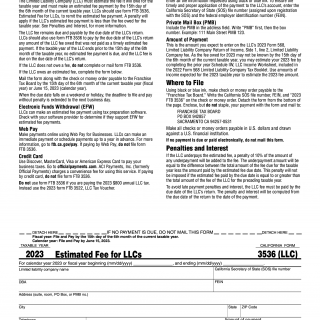

Form FTB-3536. Estimated Fee for LLCs 2023

Form 3536, also known as the Estimated Fee for LLCs form, is a document required by the Internal Revenue Service (IRS) in the United States. The primary purpose of this form is to allow Limited Liability Companies (LLCs) to estimate the amount of taxes they will owe for the upcoming tax year.

The form consists of several sections, including identifying information about the LLC, its estimated total income for the year, and the estimated tax owed based on that income. Some important fields to consider when filling out this form include the LLC's name, address, and Employer Identification Number (EIN), as well as its estimated taxable income and tax liability.

It is essential to note that accurate completion of Form 3536 is crucial as underestimating taxes could result in penalties and interest charges from the IRS. Additionally, LLC members are personally liable for any unpaid taxes owed by the business.

When filling out Form 3536, LLCs will need to provide estimated financial information, such as expected revenue and expenses for the upcoming tax year. They may also need to attach additional documents, such as their previous year's tax return or financial statements.

This form is particularly relevant for LLCs that anticipate owing taxes at the end of the year. Filling out this form accurately and completely can help LLCs avoid underpayment penalties and plan for their tax obligations effectively.

Some strengths of Form 3536 include its ability to help LLCs estimate their tax obligations and plan accordingly. However, some weaknesses may include the potential for errors or omissions in the information provided, which could lead to penalties or interest charges from the IRS.

Alternative forms that may be used in place of Form 3536 include the Form 1040-ES - Estimated Tax for Individuals, which is a similar document used by individuals to estimate their tax obligations.

Once completed, Form 3536 is typically submitted electronically to the IRS. Accurate completion of this form can have a significant impact on an LLC's future financial stability by helping them plan for and meet their tax obligations.