Form DR-15N. Instructions for DR-15 Sales and Use Tax Returns

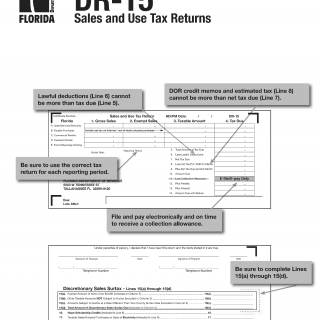

The DR-15N instructions provide guidance on how to complete the DR-15 Sales and Use Tax Return form, which is required by the Florida Department of Revenue from businesses that sell goods or services subject to sales tax. The main purpose of the form is to report the total amount of taxable sales, purchases, and use tax due for a given reporting period.

The instructions consist of several sections, including an introduction and overview of the form, information on how to fill out each section and field of the form, and details on payment options and deadlines. Key fields to consider when completing the form include gross sales, taxable sales, exempt sales, and the amount of tax collected.

The instructions also provide helpful tips and examples to assist businesses in accurately reporting their sales and use tax activity. It is important to note that failure to file the DR-15 or paying the correct amount of tax can result in penalties and interest fees.

Business owners or authorized representatives should refer to the DR-15N instructions when filling out the form and ensure they have accurate records of their sales and purchase transactions, including receipts, invoices, and other supporting documents. Additionally, businesses may need to attach schedules or supporting documentation to explain any adjustments or exemptions claimed on the form.

Submitting the DR-15N can be done electronically or by mail, and businesses are required to keep copies of the form and supporting documentation for at least three years. The form's submission can affect a business's future ability to obtain licenses or permits from the state, so it is important to file and pay the correct amount of sales and use tax due on time.

Overall, the DR-15N instructions provide comprehensive guidance on completing the DR-15 Sales and Use Tax Return form and can help businesses avoid errors or miscalculations when reporting their sales and use tax activity.