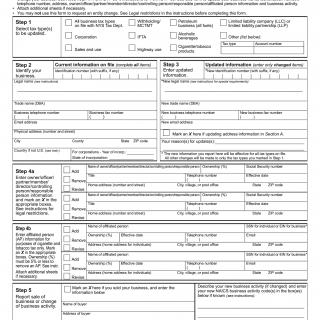

Form DTF-95. Business Tax Account Update

The DTF-95 form is the Business Tax Account Update form in New York State. It is a crucial document for businesses to update their tax account information with the New York State Department of Taxation and Finance.

The form requires accurate and up-to-date information such as the business's legal name, federal employer identification number (EIN), address, contact details, and ownership structure. It also includes fields to indicate changes in business operations, like closures, sales, or changes in entity type.

When filling out the DTF-95 form, it is important to be meticulous and provide accurate information. Any errors or omissions can lead to processing delays or penalties. Reviewing the instructions provided with the form is highly recommended to ensure compliance.

In addition to the form itself, certain supporting documents may be required. For example, changes in business ownership may necessitate partnership agreements, articles of incorporation, or certificates of dissolution.

The DTF-95 form serves several purposes, including:

- Updating business tax account information to maintain accuracy.

- Reflecting changes in the business's legal structure.

- Notifying tax authorities about business closures or sales.

Strengths:

- Facilitates accurate updates to business tax account information.

- Enhances communication between businesses and the New York State Department of Taxation and Finance.

- Helps businesses comply with tax regulations.

Weaknesses:

- Inaccurate completion of the form can result in processing delays or rejection.

- Lack of clarity in instructions may lead to confusion when filling out the form.

Opportunities:

- Online platforms can streamline the submission process and reduce errors.

Threats:

- Non-compliance with updating business information may result in penalties or legal consequences.

There are no specific alternative forms or direct analogues to the DTF-95 form as it is unique to the New York State Department of Taxation and Finance for business tax account updates.

Submitting the completed DTF-95 form can be done through mail or electronically via the New York State Department of Taxation and Finance's online platform. It is advisable to retain a copy of the form for record-keeping purposes.

Once submitted, the form and associated data are securely stored by the New York State Department of Taxation and Finance to maintain accurate business tax account records.