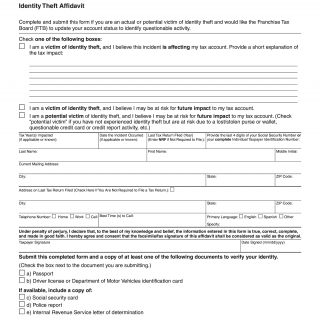

Form FTB-3552. Identity Theft Affidavit

Form FTB-3552, the Identity Theft Affidavit, is a crucial document used by individuals who have been victims of identity theft in the state of California. It serves as a means for affected individuals to report the fraudulent use of their personal information to the California Franchise Tax Board (FTB).

The form consists of several sections that require specific information from the victim of identity theft. These sections include personal details such as name, address, and social security number, as well as a description of the fraudulent activity and any known details about the perpetrators involved.

When filling out the form, it is important for the victim to provide accurate and detailed information to assist the FTB in investigating the case effectively. Supporting documents, such as police reports, credit bureau reports, and any other evidence of the identity theft, should be attached to the form to strengthen the claim.

The primary purpose of Form FTB-3552 is to initiate an investigation into the identity theft and prevent further misuse of the victim's personal information. By submitting this form, individuals can alert the FTB to fraudulent tax filings or other financial activities conducted under their stolen identity.

One strength of this form is its ability to streamline the reporting process for identity theft victims. It provides a standardized format for collecting necessary information and ensures that victims' claims are properly documented and investigated.

However, a potential weakness of the form is that it may not provide immediate resolution to the victim's situation. While it initiates an investigation, it may take time for the FTB to complete their review and take appropriate action.

Opportunities may arise from the form's existence as it allows victims to take proactive steps towards resolving their identity theft issues. It empowers individuals to protect their financial well-being and work towards restoring their stolen identity.

Threats related to the form include the possibility of submitting incomplete or inaccurate information, which could hinder the investigation process. It is essential for individuals to carefully review the form and provide all relevant details to ensure a comprehensive investigation.

There are no direct alternatives or analogues to Form FTB-3552, as it is specific to the California Franchise Tax Board's identity theft reporting process. However, there may be similar forms or procedures in other states or at the federal level that address identity theft-related concerns.

Filing Form FTB-3552 can have significant implications for the future of the participants involved. By reporting identity theft promptly, victims can take steps towards protecting their financial accounts, credit scores, and overall reputation. Additionally, the information provided on the form can aid law enforcement agencies and regulatory bodies in tracking down and prosecuting identity thieves.

Form FTB-3552 can be submitted to the California Franchise Tax Board through various channels, including online submission through the FTB's official website or by mail. Once submitted, the form and accompanying documents are securely stored by the FTB for further investigation and reference purposes.

Overall, Form FTB-3552 plays a crucial role in addressing identity theft issues in California. It provides a structured process for victims to report fraudulent activity and initiates investigations to safeguard their financial well-being. By submitting this form, individuals can contribute to combating identity theft and minimizing its impact on their lives.