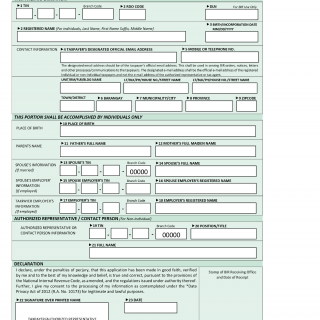

BIR Form S1905. Registration Update Sheet

The S1905 Registration Update Sheet, is a form provided by the Department of Finance's Bureau of Internal Revenue (BIR) in certain jurisdictions. It is intended for use by individuals and authorized representatives or contact persons (for non-individuals) who need to update their records within the Taxpayer Registration System. The form is specifically designed for online registration and updates.

Key Details of the Form:

-

Purpose: The form is utilized to facilitate updates to taxpayer information within the Taxpayer Registration System, ensuring accurate and up-to-date records for tax-related matters.

-

Submission Method: Taxpayers are required to provide updated information, supported by relevant documents, and to sign the declaration. The form can be submitted via email to the relevant Revenue District Office (RDO), with specific guidelines for email sender information.

-

Data Privacy Consent: The form includes a declaration where the applicant acknowledges the accuracy of the provided information and consents to the processing of their data in accordance with the Data Privacy Act of 2012 (R.A. No. 10173).

-

Checklist of Requirements: The form includes a checklist of required scanned or photocopy documents, which may include government IDs, birth certificates, marriage certificates, special power of attorney (SPA) or board resolutions/secretary's certificates for representatives, and government IDs of signatories and representatives.

-

Information Fields: The form contains sections for various types of information:

- Taxpayer Information (Individuals): Personal details, birth/incorporation date, contact information, parents' names, spouse's name and TIN (if applicable), and place of birth.

- Taxpayer Employer's Information (If employed): Employer's TIN, registered name, and branch code.

- Authorized Representative/Contact Person Information (For non-individuals): Full name.

- Declaration: A space for the signature over printed name, along with the date.

-

Designated Email Address: Taxpayers are required to provide their designated official email address, which will be used for serving BIR orders, notices, letters, and other communications. It's emphasized that this email address should be the taxpayer's official address, not that of the authorized representative or tax agent.

The form serves as a means for taxpayers to ensure their records are accurate and to comply with regulations related to taxation and data privacy. It's important to note that the form's content and requirements may vary based on the jurisdiction's specific regulations and practices, so individuals should refer to the official documentation provided by their local BIR or tax authority for the most accurate and up-to-date information.