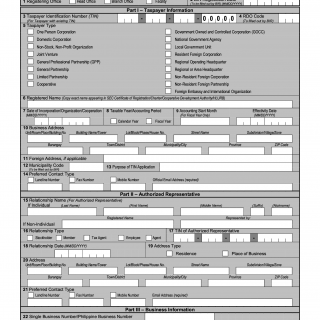

BIR Form 1903. Application for Registration for Corporations/ Partnerships

BIR Form 1903 is an official document provided by the Bureau of Internal Revenue (BIR) in the Republic of the Philippines. It is intended for corporations and partnerships, both taxable and non-taxable, including Government-Owned and Controlled Corporations (GOCCs), Local Government Units (LGUs), Cooperatives, and Associations. The form serves as an application for registration, helping entities establish their legal presence and fulfill their tax obligations.

BIR Form 1903 facilitates the registration process for corporations and partnerships in the Philippines. It collects essential information about the entity, its structure, tax types, facilities, and authorized representatives. The form is a crucial step in complying with tax regulations, ensuring that the BIR has accurate records of the entity's identity, tax liability, and other pertinent details.

Form Sections and Instructions

Part I – Taxpayer Information:

- Taxpayer Identification Number (TIN): Enter the TIN of the entity.

- RDO Code: If applicable, provide the Revenue District Office (RDO) code.

- Taxpayer Type: Mark the appropriate taxpayer type from the provided options.

- Registered Name: Enter the exact name as it appears in the relevant registration authority's documents.

- Date of Incorporation/Organization/Cooperation: Specify the date of establishment.

- Taxable Year/Accounting Period: Choose the applicable tax year and accounting period.

- Business Address: Provide the entity's main business address.

- Foreign Address: If applicable, provide the foreign address.

- Municipality Code: If applicable, provide the municipality code.

- Purpose of TIN Application: Explain the reason for applying for a TIN.

- Preferred Contact Type: Select the preferred contact method.

Part II – Authorized Representative:

- Relationship Name: Provide the name of the authorized representative.

- Relationship Type: Indicate the type of relationship with the entity.

- TIN of Authorized Representative: Provide the TIN of the authorized representative.

- Relationship Date: Specify the date of the relationship.

- Address Type: Indicate whether it's a residence or place of business.

- Address: Provide the address of the authorized representative.

- Preferred Contact Type: Select the preferred contact method.

Part III – Business Information:

- Single Business Number/Philippine Business Number: Provide the business number.

- Primary/Secondary Industries: Specify the industries associated with the entity.

- Incentive Details: Provide information about any investment promotions or incentives.

Part IV – Facility Details:

- Facility Details: Provide details about the entity's facilities.

Part V – Tax Types:

- Tax Types: Indicate the relevant tax types applicable to the entity.

Part VI – Receipts and Invoices:

- BIR Printed Receipts and Invoices: Specify whether BIR printed receipts and invoices will be used.

- Authority to Print Receipts and Invoices: Provide details about the printing of receipts and invoices.

Part VII – Stockholder/Partner/Member:

- Stockholder’s/Partner’s/Member’s Name: Provide names of stockholders, partners, or members.

Part VIII – Withholding Agent/Accredited Tax Agent Information:

- TIN: Provide the TIN of the withholding agent/accredited tax agent.

- RDO Code: Provide the RDO code.

- Withholding Agent/Accredited Tax Agent’s Name: Provide the name of the agent.

- Registered Address: Provide the agent's address.

- Contact Number: Provide the contact number.

- Declaration Stamp of BIR Receiving Office: Sign and date the declaration.

Part VIII – Payment Order Form for New Business Registrant:

- Taxpayer’s Identification Number (TIN): Provide the TIN.

- Branch Code: Specify the branch code.

- RDO Code: Provide the RDO code.

- For the Year: Specify the year.

- Taxpayer’s Name: Provide the taxpayer's name.

Documentary Requirements

This section lists the necessary documents required to support the application for registration, depending on the entity type and circumstances.

Conclusion

BIR Form 1903, Application for Registration for Corporations/Partnerships, is a comprehensive document that entities in the Philippines use to initiate their registration process with the Bureau of Internal Revenue. By accurately completing the form and attaching the required documentation, entities ensure compliance with tax regulations and establish their legal presence for tax purposes.