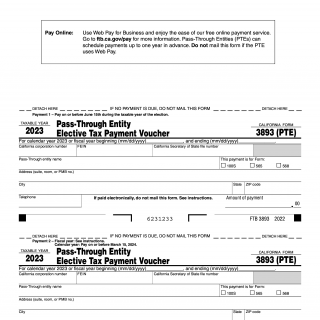

Form FTB-3893. Elective Tax Payment Voucher for Pass-Through Entity

This form is used for making elective tax payments by Pass-Through Entities (PTEs) in California for the taxable year 2023. PTEs include entities like partnerships, limited liability companies (LLCs), and S corporations. The form serves as a voucher for making tax payments to the California tax authorities.

Usage Case: PTEs in California use this form to pay their elective taxes. The form is submitted for the calendar year 2023 or a fiscal year beginning and ending on specific dates. PTEs can choose the appropriate form number (100S, 565, or 568) based on their entity type.

Structure:

-

Form Name and Number: FTB 3893 2022, a voucher for tax payments.

-

Detach Here: An instruction to detach this part of the form if no payment is due and not mail it.

-

Taxable Year: The taxable year for which the payment is being made.

-

Pass-Through Entity Information:

- California corporation number

- Federal Employer Identification Number (FEIN)

- California Secretary of State file number

- Pass-Through entity name

- Address (suite, room, or PMB number)

- City, State, ZIP code

- Telephone number

- Amount of payment

-

Payment Options:

- Payment 1 (for calendar year): Pay on or before June 15th during the taxable year of the election.

- Payment 2 (for fiscal year): Pay on or before March 15, 2024, for calendar year entities.

-

Payment Form: Located at the bottom of the page for recording payment details.

-

Pay Online: Instructions to use Web Pay for Business, a free online payment service for PTEs. The form suggests visiting the ftb.ca.gov/pay website for more information. If a PTE uses Web Pay, they are advised not to mail this form.

This form is essential for PTEs in California to fulfill their tax obligations and make elective tax payments for the specified taxable year. The form must be accurately completed and submitted in a timely manner to comply with tax regulations.