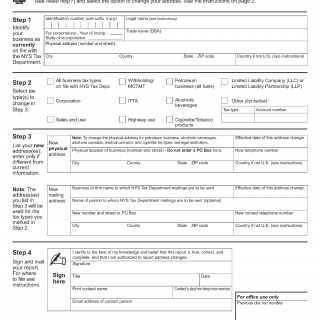

Form DTF-96. Report of Address Change for Business Tax Accounts

The DTF-96 form, also known as the Report of Address Change for Business Tax Accounts, is an important document provided by the New York State Department of Taxation and Finance. This form serves the purpose of notifying the department about a change in address for business tax accounts.

When filling out the DTF-96 form, it is crucial to provide accurate and up-to-date information to ensure proper communication between the department and the business entity. The form consists of several fields that must be completed, including the following key details:

-

Business Information: Provide the legal name and address of the business for which the address change is being reported.

-

Tax Account Information: Specify the relevant tax account numbers associated with the business, such as sales tax, corporate tax, or withholding tax account numbers.

-

Effective Date of Change: Indicate the date on which the address change will take effect or has already taken effect.

It is essential to double-check all the furnished details before submitting the form to avoid any errors or delays in processing. Additionally, the form may require supporting documentation, such as proof of the new address, to substantiate the change.

This form is primarily used when a business relocates its operations to a different address. By promptly reporting the address change, businesses can ensure compliance with tax regulations and receive important correspondence from the New York State Department of Taxation and Finance at the correct location.

An application example could be a scenario where a small business moves to a new office space within the same city. The owner would need to fill out the DTF-96 form to update their business address on record for tax purposes.

Although there aren't direct alternatives or analogues to this specific form, it is worth mentioning that various other tax-related forms may be necessary, depending on the circumstances. For example, businesses may also need to file forms like the DTF-17 (Application to Register for a Sales Tax Certificate of Authority) or the DTF-17.1 (Application for Certain Sales and Use Tax Exemptions).

Once completed, the DTF-96 form can be submitted to the New York State Department of Taxation and Finance through designated channels, such as mail or online submission portals. The department will update the business's address information in their records accordingly.

It is crucial for businesses to retain a copy of the submitted DTF-96 form for their records, ensuring they have proof of the address change notification. Storing it securely alongside other tax-related documents is recommended for future reference if needed.