Form AP-114. Texas Nexus Questionnaire

The AP-114 Texas Nexus Questionnaire is a vital document for non-Texas entities such as corporations, limited liability companies, partnerships, associations, joint ventures, holding companies, joint stock companies, and railroad companies. It plays a crucial role in determining whether these entities have sufficient nexus or connection with the state of Texas to be subject to state taxes and regulations.

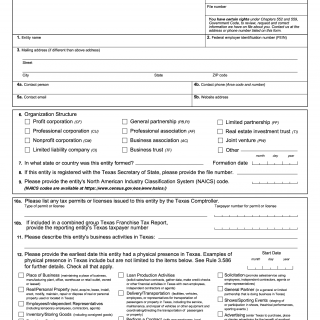

The questionnaire consists of several sections that require detailed information. While it does not follow a specific heading or subheading structure, its purpose is clear. The form seeks to collect essential data about the entity's activities, assets, and presence in Texas. By analyzing this information, the state can determine if the entity should comply with tax obligations and regulatory requirements.

When filling out the AP-114 form, it is important to consider providing accurate and comprehensive details regarding the entity's operations. The form asks for specific data, including the entity's legal name, address, federal employer identification number, date of formation/incorporation, organizational structure, ownership information, and an overview of the entity's activities within Texas.

In addition to these fields, the questionnaire may require supporting documentation to substantiate the provided information. This might include financial statements, partnership agreements, organizational charts, business licenses, and copies of contracts with Texas-based entities. These attachments strengthen the credibility of the entity's responses and aid in the assessment process.

Practical examples of when the AP-114 form is necessary include a foreign corporation expanding its operations into Texas, an out-of-state partnership conducting business activities within the state, or a holding company with Texas-based subsidiaries. By completing the questionnaire, entities ensure compliance with Texas laws and regulations, avoid penalties, and maintain good standing.

Strengths of the AP-114 form lie in its ability to standardize the information collection process, enabling a consistent evaluation of nexus across different non-Texas entities. It helps the state identify potential tax revenues and ensures fair treatment of businesses operating within its jurisdiction.

However, the form also has some weaknesses. Its complexity and detailed nature may pose challenges for entities unfamiliar with Texas tax requirements. Moreover, subjective interpretation of nexus criteria could lead to discrepancies in determining tax liability.

Opportunities arise from the form's ability to facilitate transparency between the state and non-Texas entities, fostering a cooperative environment. By analyzing the collected data, the state can identify opportunities for business growth, economic development, and targeted policy initiatives.

There are no direct threats associated with the AP-114 form itself. However, failure to complete and submit the questionnaire accurately and on time may result in penalties, additional scrutiny, or potential legal consequences for non-compliant entities.

While there may not be direct alternatives to the AP-114 form, similar documents exist in different states to determine tax nexus and compliance. These forms may differ in format, terminology, and specific requirements, reflecting variations in state tax laws and regulations.

The accurate completion of the AP-114 form is crucial for a non-Texas entity's future participation in the state's economy. It establishes a foundation for proper tax reporting, compliance, and eligibility to conduct business activities within Texas. Failure to comply with the form's requirements could result in financial losses, reputational damage, and legal complications.

Once completed, the AP-114 form is typically submitted to the Texas Comptroller of Public Accounts through their designated online portal or via mail. The state retains these forms in a secure database for reference and auditing purposes.

In summary, the AP-114 Texas Nexus Questionnaire serves as a comprehensive tool for non-Texas entities to establish their tax nexus with the state. By providing accurate information and supporting documentation, entities ensure compliance with tax obligations and regulatory requirements. While it has strengths in standardizing the evaluation process, challenges and complexities exist. Nonetheless, completing this form correctly influences the entity's future relationship with Texas and its ability to operate within the state's jurisdiction.