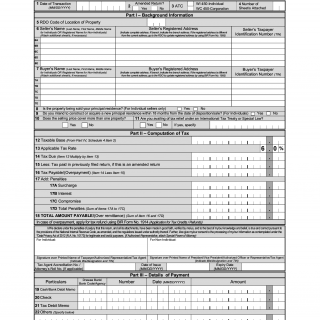

BIR Form 1706. Certificate of Final Income Tax Withheld

The BIR Form 1706, also known as the Certificate of Final Income Tax Withheld, is a crucial document issued by the Bureau of Internal Revenue (BIR) in the Philippines. It serves as proof that final income taxes have been withheld and paid by a withholding agent on behalf of the taxpayer.

This form consists of several important fields that need to be accurately filled out. These fields include the taxpayer's name, taxpayer identification number (TIN), registered address, nature of income payment, amount of income payment subject to final tax, and the corresponding amount of tax withheld.

When filling out BIR Form 1706, it is essential to consider the following points:

-

Parties Involved: The parties involved in this form are the taxpayer and the withholding agent (e.g., an employer or a person making income payments to the taxpayer).

-

Required Data: The form requires specific data such as the taxpayer's personal information, details of income payments subject to final tax, and the corresponding tax withheld.

-

Additional Documents: In addition to the completed form, the taxpayer must attach supporting documents such as a summary Alphalist of Withholding Taxes (SAWT) and a copy of the BIR Form 2316 (Certificate of Compensation Payment/Tax Withheld) issued by the employer.

Application Examples and Use Cases:

- An employee who has resigned and received final compensation from their employer would need to file BIR Form 1706 to declare and verify the taxes withheld on their income.

- A freelancer receiving income subject to final tax would need to complete this form to ensure proper documentation and payment of the relevant taxes.

Related Forms and Differences:

- BIR Form 1604CF (Annual Information Return of Income Taxes Withheld on Compensation) is a related form used by employers to report annual withholding tax information for employees. However, BIR Form 1706 specifically focuses on final income tax withheld.

- BIR Form 1701Q (Quarterly Income Tax Return) is another related form used for reporting quarterly income tax liabilities. Unlike BIR Form 1706, it covers all income taxes and is not specific to final withholding.

Submitting and Storage: Once completed, BIR Form 1706 can be submitted to the BIR Regional District Office or Revenue District Office where the taxpayer is registered. The form should be filed within ten (10) days after the end of the month when the withholding was made. The BIR retains copies of the forms as part of their records and verification processes.

In conclusion, BIR Form 1706 plays a vital role in documenting and verifying the final income taxes withheld on behalf of taxpayers in the Philippines. By accurately completing this form and attaching the required documents, individuals ensure compliance with tax regulations and contribute to the proper assessment and collection of taxes.