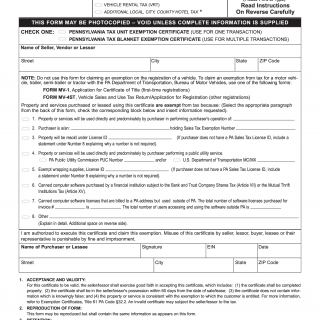

Form REV-1220. Pennsylvania Tax Exemption Certificate

The REV-1220 form, also known as the Pennsylvania Exemption Certificate, is an official document provided by the Pennsylvania Department of Revenue. This form allows eligible entities to claim exemptions from certain state taxes when making purchases of goods or services within the state of Pennsylvania. The purpose of the form is to facilitate tax-exempt transactions for specific categories of organizations and transactions.

Components of the REV-1220 Form:

-

Entity Information: The form requires the basic information of the tax-exempt entity, including its legal name, address, and taxpayer identification number (TIN). This information helps identify the organization and ensure that it is indeed eligible for tax exemptions.

-

Type of Exemption: The form provides various checkboxes or fields where the entity can indicate the specific type of exemption they are claiming. This could be related to nonprofit status, resale transactions, government entities, educational institutions, and other eligible categories.

-

Description of Purchases: The form typically includes a section where the entity needs to describe the type of purchases for which they are seeking exemption. This could involve specifying categories of goods or services, along with relevant details such as quantities and intended use.

-

Certification and Signature: To validate the exemption claim, the form requires a signature from an authorized representative of the tax-exempt entity. This signature serves as a legal attestation that the information provided is accurate and that the entity qualifies for the claimed exemption.

-

Date: The date of the exemption claim is often required on the form. This indicates the date when the form was completed and submitted.

-

Additional Documentation: Depending on the specific exemption being claimed, the form might require additional documentation to support the claim. This could include copies of the entity's tax-exempt status determination letter or other relevant documents.

Submission and Use:

Once completed, the REV-1220 form is submitted to vendors or suppliers at the time of purchase. The vendor retains the form as a record of the tax-exempt transaction and for compliance with state tax regulations. The vendor's records must align with the information provided on the form to avoid potential issues during tax audits.

It's important to note that while the REV-1220 form allows for tax exemptions on eligible transactions, it does not grant blanket tax exemptions for all transactions. Each claim should be valid and in accordance with the regulations set by the Pennsylvania Department of Revenue.

Before using the REV-1220 form, organizations should ensure that they meet the criteria for the claimed exemption and understand the rules and guidelines outlined by the state. Additionally, it's recommended to consult legal or tax professionals to ensure accurate completion and submission of the form.

PA Tax Exemption Use Cases:

-

Nonprofit Organizations: Nonprofit organizations that are recognized by the state of Pennsylvania as tax-exempt entities can use the REV-1220 to exempt themselves from paying sales tax on eligible purchases. This includes purchases of supplies, equipment, and other goods necessary for their operations.

-

Government Entities: Federal, state, and local government agencies operating within Pennsylvania can use the REV-1220 to claim exemptions from various taxes when acquiring goods and services. This ensures that taxpayer funds are not subject to double taxation.

-

Educational Institutions: Schools, colleges, and universities can use the Pennsylvania Exemption Certificate for tax-free purchases of educational materials, equipment, and supplies needed for academic and administrative purposes.

-

Healthcare Organizations: Hospitals, clinics, and other healthcare facilities can benefit from tax exemptions provided by the REV-1220 when purchasing medical equipment, supplies, and pharmaceuticals required for patient care.

-

Charitable Organizations: Charities and religious organizations can utilize the exemption certificate to avoid paying sales tax on items they purchase for charitable activities, fundraising events, and religious ceremonies.

-

Manufacturing Companies: Manufacturing companies can claim exemptions on purchases of raw materials, machinery, and equipment used in their production processes, reducing the tax burden associated with their operations.

-

Agricultural Enterprises: Farmers and agricultural businesses can use the certificate to exempt themselves from taxes on purchases of equipment, seeds, and other agricultural inputs.

-

Resale Transactions: Businesses that purchase goods for resale purposes can use the REV-1220 to avoid paying sales tax on those items, as the tax will ultimately be collected when the products are sold to end consumers.

-

Energy and Utility Companies: Companies involved in energy production, distribution, and utilities can claim tax exemptions on purchases of equipment and materials essential for maintaining their operations.

-

Research and Development: Entities engaged in research and development activities can benefit from tax exemptions on purchases of laboratory equipment, materials, and supplies necessary for their projects.

-

Government Contractors: Businesses contracting with government agencies can use the exemption certificate for tax-free purchases related to fulfilling their contractual obligations.

-

Lease and Rental Exemptions: The certificate can be used to claim exemptions on items leased or rented by tax-exempt entities, allowing them to avoid paying unnecessary taxes on such transactions.

In each of these use cases, the REV-1220 helps eligible entities reduce costs by legally exempting them from specific state taxes, supporting their respective missions, activities, and operations within Pennsylvania. It's important for organizations to adhere to the regulations and guidelines provided by the Pennsylvania Department of Revenue to ensure proper and lawful utilization of the exemption certificate.