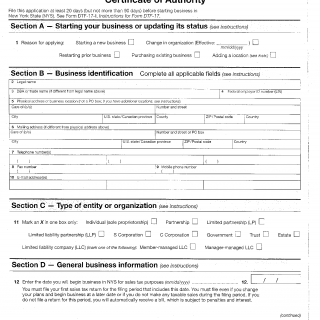

Form DTF-17. Application to Register for a Sales Tax Certificate of Authority

The DTF-17 form, also known as the Application to Register for a Sales Tax Certificate of Authority, is a crucial document provided by the New York State Department of Taxation and Finance. This form serves the purpose of registering businesses for a Sales Tax Certificate of Authority in the state of New York.

The application consists of several sections that require specific information from the applicant. These sections include general business information, ownership details, and tax reporting specifications. Key fields within the form may include the legal name of the business, address, ownership type, Social Security numbers or Employer Identification Numbers (EINs) of owners, estimated sales tax liability, and banking information for electronic funds transfer.

When filling out the DTF-17 form, it is essential to consider accuracy and completeness. Any errors or omissions could result in delays or complications with the registration process. Additionally, applicants must ensure they have supporting documentation ready, such as a copy of their Certificate of Incorporation, partnership agreement, or other relevant legal documents.

Businesses across various industries and sectors in New York State are required to complete the DTF-17 form. For example, retail stores, restaurants, service providers, and online sellers engaging in taxable transactions within the state would typically need to register for a Sales Tax Certificate of Authority.

It's important to note that while the DTF-17 form is specific to New York State, other states may have similar forms or processes for sales tax registration. Businesses operating outside of New York should consult the respective state's department of taxation or revenue for the appropriate form and guidelines.

Once completed, the DTF-17 form can be submitted electronically through the New York State Department of Taxation and Finance website or via mail to the department's designated address. The submitted form is stored electronically in the department's database for record-keeping and verification purposes.

In summary, the DTF-17 form is a vital application for businesses operating in New York State to register for a Sales Tax Certificate of Authority. It requires accurate and complete information, along with supporting documentation. By submitting this form, businesses comply with the state's tax regulations and gain the authority to collect and remit sales tax.