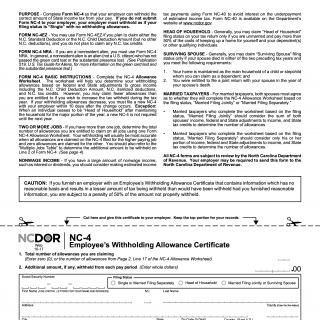

Form NC-4. Employee's Withholding Allowance Certificate

The Employee's Withholding Allowance Certificate NC-4 is a form issued by the North Carolina Department of Revenue. It serves as a means for employees to designate their tax withholding preferences for state income taxes in North Carolina.

This form consists of several important fields that the employee needs to fill out accurately. These fields include personal information such as name, address, social security number, and filing status (single, married filing jointly, etc.). Additionally, employees need to specify the number of allowances they wish to claim, which affects the amount of tax withheld from their paychecks.

When filling out the form, it is essential to consider various factors. Employees should carefully assess their tax situation to determine the appropriate number of allowances to claim. Claiming too few allowances may result in higher tax withholdings, while claiming too many allowances may lead to underpayment and potential penalties.

No additional documents are typically required when submitting the Employee's Withholding Allowance Certificate NC-4. However, employees should ensure that they have accurate records of their income, deductions, and any other relevant tax information for reference.

Practical examples and use cases for this form include new hires completing the NC-4 form when starting a job, individuals who experience changes in their marital status or dependents updating their withholding information, and employees adjusting their withholding preferences due to changes in their financial circumstances.

While there are no direct alternatives or analogues to the NC-4 form, it's worth noting that other states may have similar forms for state income tax withholding purposes. However, the specific requirements and fields on those forms may vary.

Once completed, the Employee's Withholding Allowance Certificate NC-4 is typically submitted to the employer or payroll department. The employer uses the information provided on the form to calculate the appropriate amount of state income tax to withhold from the employee's wages. Employers are required to keep these forms on file for a certain period, as mandated by state laws.

Overall, the Employee's Withholding Allowance Certificate NC-4 is a crucial document that ensures accurate tax withholding for North Carolina state income taxes. By completing this form correctly, employees can effectively manage their tax obligations and avoid potential issues with underpayment or overpayment of state taxes.