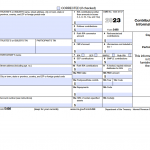

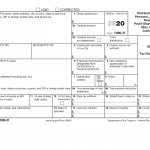

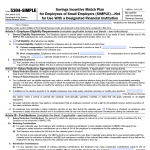

IRS Form 5304-SIMPLE. Savings Incentive Match Plan for Employees of Small Employers

IRS Form 5304-SIMPLE is a form that is used to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA plan. This form is used by employers to establish a SIMPLE IRA plan for their employees.

The form consists of three parts: