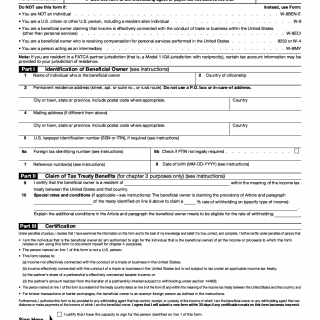

IRS Form W-8BEN. Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting

IRS Form W-8BEN is a certificate of status of beneficial owner for United States tax withholding and reporting. The primary purpose of this form is to certify a foreign individual's or entity's status as a beneficial owner of income subject to withholding by a US withholding agent.

The form consists of four parts: Part I, which requires the individual's or entity's personal information; Part II, which requires the individual's or entity's claim of treaty benefits; Part III, which requires the individual's or entity's certification of beneficial owner status; and Part IV, which requires the individual's or entity's signature and date.

The important fields of the form include the individual's or entity's name, address, country of residence, taxpayer identification number, and type of income being received. It is important to consider the accuracy and completeness of the information provided when filling out the form, as any errors or omissions may result in the withholding agent applying a higher withholding rate or refusing to withhold altogether.

The parties involved in the form are the foreign individual or entity and the US withholding agent. It is important to note that the form is not a request for a tax refund, but rather a certification of status for tax withholding and reporting purposes.

When writing the form, the individual or entity will need to provide their personal information, including their name, address, country of residence, and taxpayer identification number. Depending on the type of income being received, additional information and documentation may be required, such as a tax treaty between the individual's or entity's country of residence and the United States.

Application examples of the form include foreign individuals or entities receiving income from US sources, such as dividends, interest, or royalties. Practice and use cases of the form include foreign students receiving scholarships or grants from US universities or foreign entertainers receiving income from US performances.

Strengths of the form include its ability to provide a clear and standardized certification of status for tax withholding and reporting purposes. Weaknesses of the form include the potential for errors or omissions in the information provided, which may result in the withholding agent applying a higher withholding rate or refusing to withhold altogether. Opportunities of the form include its potential to facilitate cross-border transactions and investments. Threats of the form include potential changes in tax laws and regulations that may affect its applicability.

Related forms include IRS Form W-8BEN-E for entities, as well as various other IRS forms for different types of income and withholding situations. Analogues of the form include similar certification forms used in other countries for tax withholding and reporting purposes.

The form affects the future of the participants by ensuring compliance with US tax laws and regulations, as well as facilitating cross-border transactions and investments. The form is typically submitted to the US withholding agent, who is responsible for withholding the appropriate amount of tax and reporting the income to the Internal Revenue Service. The form is typically stored by the withholding agent for a period of time as required by US tax laws and regulations.