IRS Form 8606. Nondeductible IRAs

Tax form 8606 is becoming increasingly important due to the popularity of the Roth IRA and the right to roll over after-tax assets from qualified plans offered by employers, such as a 401 (k) or 403 (b).

Essentially, you must file Form 8606 for each year that you contribute after-tax amounts (non-deductible contributions) to your traditional IRA. Conversions from traditional, SEP, or SIMPLE IRAS must also be specified in form 8606. In addition, you must submit a form each year when you receive a mailing list from your Roth IRA or your traditional IRA if you have ever previously deposited after-tax amounts.

Key takeaways

- IRS form 8606 is a tax form distributed by the internal revenue Service and used by registrars who make non-deductible contributions to an IRA.

- Any taxpayer with a base value above zero for IRA assets must use form 8606 to Pro rata the taxable and non-taxable distribution amounts.

- It is important to keep copies of your supporting documents and Form 8606, as this may be useful in determining how your transactions were treated for tax purposes in the future.

Non-deductible (after-tax) IRA contributions

The taxability of the distribution of your retirement account is usually determined by whether the assets relate to pre-tax or post-tax contributions. 2 If your assets are in a qualified plan with your employer, then your plan administrator or other designated professional is responsible. tracking your pre-tax compared to your after-tax assets. For your IRA, the responsibility lies with you as the owner.

Traditional IRA deposits

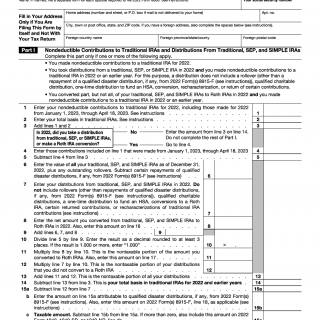

If a taxpayer does not require a deduction for their traditional IRA contribution, this is usually either because they do not meet the criteria, or because they simply choose not to. A person who is entitled to a deduction may choose not to claim it, so that their future distributions of the amount are not subject to taxes and penalties. Regardless of the reason, the taxpayer must complete IRS form 8606 to notify the IRS that the Deposit is not deductible (counting after-tax assets).3 to report an after-tax contribution, an individual must complete part l of form 8606.4

Transfer of after-tax assets from qualified plans

One of the things that many people don't know about an IRA is that they can transfer after-tax assets from their qualified plan accounts to traditional IRAS. According to IRS publication 590-A: "Form 8606 is not used during the year in which you switch from a qualified retirement plan to a traditional IRA, and the transfer includes tax-free amounts. In these situations, form 8606 is filled out for the year you take the distribution from this IRA. " 5 however, it may still be a good idea to fill out the form for your records.

Distributions

Form 8606 should be filed each year when the distribution comes from a traditional, SEP, or SIMPLE IRA, if any of these IRAS contain after-tax amounts. Failure to complete form 8606 may result in the individual paying income tax and a penalty for early distribution of amounts that should be tax-free and unpunished.5 The distribution of assets after tax is also reflected in part I of the form.4

Distribution is proportional

As mentioned above, if your traditional IRA has after-tax amounts, you must determine when distributing how much of the distribution relates to the after-tax amount. It is assumed that your "base cost" is equal to the amount of your after-tax contributions. The part of the distribution that is not taxable must be proportional to the amounts that are taxable.

For example, an individual has deposited $ 2,000 in after-tax amounts and has a pre-tax balance (including contributions and income) in a traditional IRA of $ 8,000 for a total of $ 10,000. The distribution of $ 5,000 will be pro-rata, taking into account $ 1,000 after tax and $ 4,000 in pre-tax amounts. This proportionate treatment should continue until your entire cost is distributed.

IRA aggregated

To determine the portion of the IRA distribution that is taxable, taxpayers must aggregate all of their traditional balances, the SEP, and JUST the IRA. This requirement applies even if the after-tax contribution was made to only one IRA. The step-by-step instructions for part I on the form will help a person calculate the taxable portion of the distribution.

Roth IRA conversions

A person who converts their traditional, SEP, or SIMPLE IRA to a Roth IRA should be able to distinguish between conversion assets and amounts representing regular RRA IRA contributions and income. This distinction is necessary to determine whether any portion of the Roth IRA distribution is subject to income tax and/or a fine. To correctly account for these conversion amounts, a person must complete part II of form 8606.7.

Distributions From Roth IRAs

Part III of form 8606 is filled in to report distributions taken from Roth's IRA. Completing this section allows an individual to determine whether any portion of his or her Roth IRA distribution is taxable and / or subject to a 10% early distribution penalty if accepted before the age of 59½.8 years.

Recharacterizations

A person who re-characterizes a Roth conversion or Ira contribution must attach a letter (application) to his or her tax return explaining the re-characterization. In this email, for example, you will include the amount related to the Deposit or conversion and the amount related to the profit (or specify whether there was a loss of this amount). The verbiage and information included in the statement is determined by whether the individual recontexts from the traditional IRA to the Rota IRA or Vice versa, or whether the individual rehashes the Rota transformation. For examples of information that should be included in the statement, see In the instructions for filling out form 8606. 9

Re-characterization of Roth's conversion to a traditional, SEP, or SIMPLE IRA was prohibited by the tax cuts and jobs Act for tax periods from 2018 to 2025.

Form 8606 should not be submitted if the entire contribution or conversion is changed. However, if only part of the contribution or conversion is changed, the person must complete part I of form 8606. In any case, the application must be submitted together with the tax return.

Fines

A person who does not submit Form 8606 to report a non-deductible contribution will have to pay the IRS $50. In addition, if the non-deductible amount is overstated on the form, a $100 fine will apply. In both cases, the fine may be waived if the taxpayer can provide a reasonable reason for non-compliance.10 the IRS usually considers "reasonable cause" in situations such as: death, serious illness, incapacity, inability to obtain records, natural disaster, or other extreme circumstances. This is always considered individually based on the specific facts of your situation.

Other considerations

Divorce

Generally, the transfer of IRA assets from one spouse to another is not taxable to either spouse if the transfer is made in accordance with a divorce or legal separation agreement. If this transfer results in a change of ownership of the after-tax amounts, both spouses must file Form 8606 to show the after-tax amount owned by each. A letter explaining the changes must be attached to each spouse's tax return. 11 it is Always helpful to consult a financial professional to split retirement accounts in a divorce, to ensure that no penalties for tax payments or penalties for early distribution are accrued on the transfer.

Inherited IRAS

Individuals who inherit an IRA that includes after-tax amounts or "base" must also file form 8606 to claim the non-taxable portion of the distribution. It is important to note that the base amount in the inherited IRA cannot be combined with any base in the beneficiary's regular, non-inherited IRA (i.e., an IRA that the beneficiary has established with their own contributions). This rule is one of the exceptions to another rule that requires aggregation of all traditional IRA balances (explained above) when calculating the Pro rata portion after taxes.

For example, let's say that a person has a traditional IRA that they set up and funded, and that IRA includes only pre-tax amounts. If this person inherits a traditional IRA that includes after-tax amounts, their distribution from the inherited IRA will need to be prorated to determine the amounts related to after-tax assets, and the recipient's own IRA balance will not be included in this calculation.

On the other hand, let's assume that the same person had a traditional IRA that they set up and funded with both pre-and post-tax amounts. They inherit the traditional IRA, which also includes after-tax amounts. When they take distributions from a legacy IRA and their own IRA, they will need to file a separate form 8606 for each account, because the basis is calculated separately.

The Bottom Line

Now you should have a good understanding of the importance of filling out form 8606. As we have shown, filling out this form can mean saving on taxes, while refusing to file can result in paying IRS tax and penalties on amounts that are actually tax and fine-free.

It is important to note that the information provided here is only a guide and that each individual's circumstances may require some modification of the General filing requirements. If you are not sure whether you need to fill out form 8606, be sure to ask your tax Advisor. And for each year that you file this form, keep copies with your tax return. This may be useful in the future to determine how your transactions were treated for tax purposes.