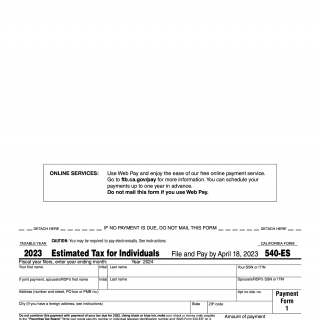

FTB Form 540-ES. Estimated Tax for Individuals

The FTB Form 540-ES, also known as Estimated Tax for Individuals, is a tax form used by individuals in California to pay estimated taxes throughout the year. The main purpose of this form is to help taxpayers avoid underpayment penalties by paying estimated taxes based on their expected income for the year.

The form consists of several parts, including personal information, estimated tax payments, and payment vouchers. Important fields include the taxpayer's name, social security number, estimated income, deductions, and credits. The parties involved are the taxpayer and the state of California.

When writing this form, it is important to have an estimate of your taxable income and deductions for the year, as well as the amount of tax owed based on that estimate. The form must be signed and dated by the taxpayer, and payment vouchers must be included with any payments made.

Examples of when this form may be used include when a California resident has income from sources that are not subject to withholding, such as self-employment income, rental income, or investment income. The form may also be used by individuals who expect to owe taxes for the year and want to avoid underpayment penalties.

Strengths of this form include its ability to help taxpayers avoid underpayment penalties and stay current on their tax obligations. Weaknesses may include the complexity of the form and the potential for errors when filling it out.

Alternative forms and analogues to Form 540-ES include the federal estimated tax form (Form 1040-ES) and the California Nonresident or Part-Year Resident Income Tax Return (Form 540NR). The main difference between Form 540-ES and Form 540NR is that the latter is used by nonresident or part-year residents of California.

The submission and storage of Form 540-ES can be done electronically or by mail. It is important to keep a copy of the completed form and payment vouchers for future reference. The form affects the future of the participants by helping them avoid underpayment penalties and stay current on their tax obligations.