FTB Form 540 2EZ. California Resident Income Tax Return

The FTB Form 540 2EZ, also known as the California Resident Income Tax Return, is a simplified tax form used by California residents to report their income, deductions, credits, and tax liability for the year. The main purpose of this form is to determine the amount of state income tax that an individual owes to the state of California.

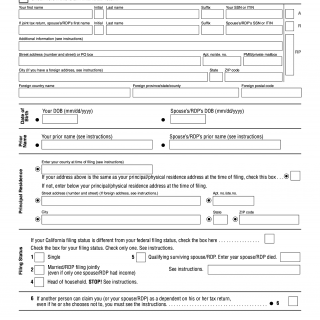

The form consists of just one page and includes several parts, including personal information, income, adjustments, and tax liability. Important fields include the taxpayer's name, social security number, filing status, income sources, and deductions. The parties involved are the taxpayer and the state of California.

When writing this form, it is important to consider the eligibility requirements for using the form, which include having only certain types of income and not claiming any dependents or itemized deductions. The form must be signed and dated by the taxpayer, and any additional documents must be attached as required.

Examples of when this form may be used include when a California resident has only certain types of income, such as wages, salaries, tips, taxable scholarship or fellowship grants, unemployment compensation, or Alaska Permanent Fund dividends. The form may also be used by individuals who do not have any dependents or itemized deductions.

Strengths of this form include its simplicity and ease of use for individuals with less complex tax situations. Weaknesses may include its limited eligibility requirements, which may exclude some taxpayers with more complex tax situations.

Alternative forms and analogues to Form 540 2EZ include the Form 540 California Resident Income Tax Return, which is a more comprehensive form for individuals with more complex tax situations. The main difference between Form 540 2EZ and Form 540 is the level of complexity and the eligibility requirements for using each form.

The submission and storage of Form 540 2EZ can be done electronically or by mail. It is important to keep a copy of the completed form for future reference. The form affects the future of the participants by determining their state income tax liability and any potential refunds or payments owed to the state of California.