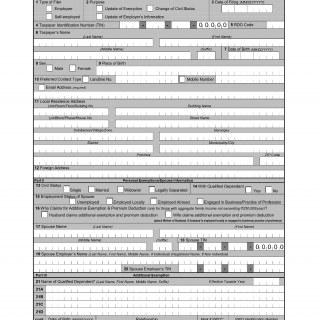

BIR Form 2305. Certificate of Update of Exemption and of Employer's and Employee's Information

BIR Form 2305 is a form used by employers in the Philippines to update the exemption status and other information of their employees. It is also used by employees to update their personal information with their employer and the Bureau of Internal Revenue (BIR).

The main purpose of this form is to ensure that the employer has the correct information about their employees and to update the employee's exemption status for tax purposes. This form is important because it affects the amount of taxes that will be deducted from an employee's salary.

The form consists of several parts, including a section for the employee's personal information, a section for the employer's information, a section for exemptions, and a section for other information. The important fields include the employee's name, address, TIN, and exemption status.

It is important to consider the accuracy and completeness of the information provided on the form when filling it out, as false or incomplete information can result in penalties. Additionally, it is important to attach any necessary supporting documents, such as a birth certificate or marriage certificate, to the form.

The parties involved in the use of this form include the employee, the employer, and the BIR.

This form is required for all employees and is used by employers to update the employee's information and exemption status. It is important for both employers and employees to be familiar with this form and its requirements.

Strengths of this form include its ability to ensure that the employer has accurate information about their employees and to update the employee's exemption status for tax purposes. Weaknesses include the potential for errors or omissions on the form, which can result in penalties.

Related forms include BIR Form 1905, which is used to update the employee's status with the BIR, and BIR Form 2316, which is used to provide the employee's income and taxes withheld for the year. Analogues include W-4 forms in the United States, which are used to update the employee's withholding information.

The use of this form can affect the future of the participants by ensuring that the correct amount of taxes are deducted from the employee's salary, avoiding penalties and issues with the BIR.

The form can be submitted to the employer or to the BIR, and is stored in BIR records for a period of time.