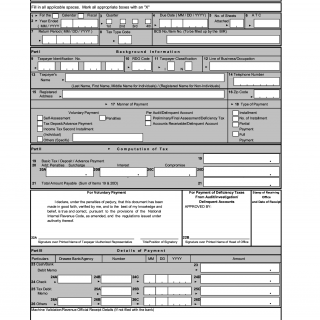

BIR Form 0605. Payment Form

BIR Form 0605, also known as the Payment Form, is a form used by individual taxpayers and businesses to pay their taxes and fees to the Bureau of Internal Revenue (BIR) in the Philippines.

The main purpose of the form is to facilitate the payment of taxes and fees to the BIR. The form consists of several parts, including information about the taxpayer or business, the type of tax or fee being paid, and the amount of the payment.

Some of the important fields on the form include the taxpayer or business name, taxpayer identification number (TIN), and the type of tax or fee being paid. Other important fields include the period covered by the payment and the amount of the payment.

When completing the form, it is important to consider the type of tax or fee being paid and the corresponding regulations and guidelines. In addition to completing the form, taxpayers may need to provide additional documentation, such as a copy of their tax return or other supporting documents.

Examples of when to use this form include paying income tax, value-added tax (VAT), and other taxes and fees required by the BIR.

Strengths of this form include its simplicity and ease of use, while weaknesses may include the potential for errors in completing the form and delays in processing. Opportunities for improvement may include adding additional resources for taxpayers to access, such as online tutorials or support services.

Alternative forms that may be related to this form include the BIR Form 1701Q, which is used to file quarterly income tax returns, and the BIR Form 2551M, which is used to file monthly VAT returns.

To fill and submit the form, taxpayers can download it from the BIR website or obtain a copy from a local BIR office. The completed form can be submitted in person at a BIR office or through an authorized agent bank. Once submitted, the form is stored in the BIR's records for future reference.