Texas Sales and Use Tax Resale Certificate

The Texas Sales and Use Tax Resale Certificate is a form used by businesses in Texas to purchase goods and services tax-free that will be resold or leased to a customer. The main purpose of the form is to allow businesses to avoid paying sales tax on items that will be resold or leased to their customers.

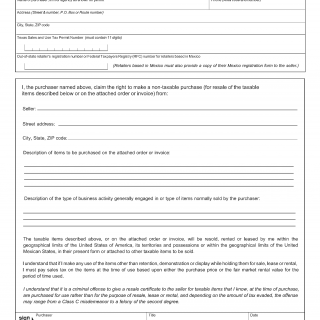

The form consists of two parts: the first part collects information about the purchaser, including their name, address, and sales tax permit number. The second part collects information about the seller, including their name, address, and the type of items being purchased.

Important fields on the form include the purchaser's name and address, sales tax permit number, and the seller's name and address. Businesses must ensure that the information provided on the form is accurate and up-to-date to avoid any potential issues with the Texas Comptroller's office.

When compiling the form, businesses will need to provide their sales tax permit number and the name and address of the seller from whom they are purchasing goods or services. No additional supporting documents are required to be attached to the form.

Application examples and use cases for the Texas Sales and Use Tax Resale Certificate include a retailer purchasing inventory from a wholesaler or a contractor purchasing building materials from a supplier.

Strengths of the form include the ability for businesses to save money on sales tax and avoid double taxation. Weaknesses include the potential for misuse of the form and the need for businesses to keep accurate records of all purchases made with the form. Opportunities for businesses include the potential for increased profits and savings, while threats include potential fines and penalties for misuse of the form.

Related forms include the Texas Sales and Use Tax Return, which businesses must file to report their sales and use tax liability, and the Texas Sales Tax Exemption Certification, which is used to claim exemption from sales tax on specific items.

Overall, the Texas Sales and Use Tax Resale Certificate can have a positive impact on the future of businesses by allowing them to save money on sales tax and increase profits. The form is submitted to the seller at the time of purchase and should be kept on file by both the purchaser and the seller for at least four years.