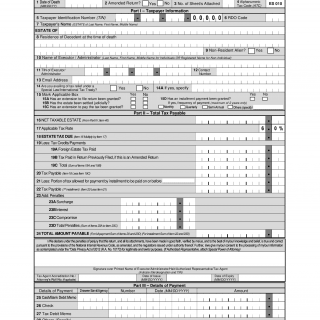

BIR Form 1801. Estate Tax Return

The BIR Form 1801 is an Estate Tax Return form in the Philippines. It is used to report the transfer of the net estate of a deceased person to their heirs or beneficiaries. The form is required to be submitted to the Bureau of Internal Revenue (BIR) within six months from the date of the decedent's death.

The form consists of several important sections, including the general information of the decedent, computation of the estate tax due, and the declaration of the executor or administrator of the estate. The estate tax due is computed based on the net estate of the decedent, which is the fair market value of their assets less their liabilities at the time of their death.

The parties involved in the form are the deceased person's heirs or beneficiaries, the executor or administrator of the estate, and the BIR.

When writing the form, the data required includes the decedent's personal information, such as their name, address, and tax identification number, as well as the details of their assets and liabilities. Additionally, supporting documents, such as a death certificate and a list of the decedent's assets and liabilities, must be attached to the form.

Examples of application and practice of the form include when a person passes away and their estate needs to be transferred to their heirs or beneficiaries. The form is necessary to ensure that the transfer is properly documented and taxed.

Strengths of the form include its clear and detailed instructions, while weaknesses may include the complexity of the computation of the estate tax due. Opportunities related to the form may include the potential for the BIR to simplify the process, while threats may include the possibility of fraudulent reporting of the net estate.

Alternative forms or analogues to the BIR Form 1801 may include estate tax forms in other countries, but the differences lie in the specific requirements and computation methods used.

The form affects the future of the participants by ensuring that the transfer of the decedent's estate is properly documented and taxed, which can help prevent legal disputes and penalties.

The form is submitted to the BIR, either in person or through an authorized representative, and a copy is kept by the executor or administrator of the estate for their records.