Form 50-144. Business Personal Property Rendition of Taxable Property

The Form 50-144 is a Business Personal Property Rendition of Taxable Property form used in Texas to report taxable personal property owned by businesses. The main purpose of this form is to provide the local county appraisal district with information about the value and location of a business's taxable personal property, which includes furniture, fixtures, equipment, inventory, and other assets.

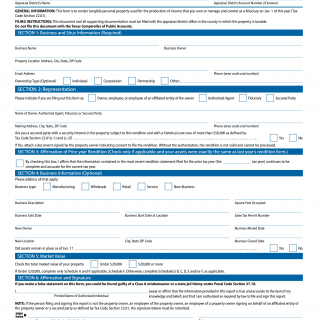

The form consists of several parts, including general information about the business, a description of the property being reported, and the property's estimated value. Important fields on the form include the business's name and address, the property's physical location, and a detailed description of each item of taxable personal property being reported.

Business owners or their authorized representatives are the parties responsible for filling out and submitting the Form 50-144. When filling out the form, it's important to consider accuracy and completeness, as well as providing any supporting documentation that may be required by the local county appraisal district.

Data required when filling out the form includes information about the business, such as its legal name and taxpayer ID number, as well as details about the taxable personal property being reported, such as its quantity, type, age, and condition. Depending on the appraisal district, additional documents may be required, such as asset listings, depreciation schedules, or purchase invoices.

Examples of application and use cases for the Form 50-144 include annual reporting requirements for businesses operating within the state of Texas, as well as during property tax audits or assessments. Strengths of the form include its ability to provide accurate valuation of taxable personal property, while weaknesses may include the potential for errors or omissions without proper guidance or expertise. Opportunities for improvement may include digitization and automation of the reporting process, while threats may include changes in tax laws or regulations impacting the reporting requirements.

Related forms may include the Federal Form 4562 - Depreciation and Amortization, which reports depreciation expenses on a business's tax return, or the Texas Form 50-249 - Dealer's Heavy Equipment Inventory Declaration form, which reports heavy equipment inventory owned by dealers. The primary difference between these forms is their specific focus on different types of assets.

Failing to submit the Form 50-144 or submitting incomplete or inaccurate information can result in penalties, fines, and even legal action. Therefore, it is important for businesses to understand the reporting requirements and comply with them accordingly.

The form is typically submitted to the local county appraisal district where the property is located and stored in their records. Business owners should also keep a copy of the completed form and any supporting documentation for their own records.