Texas Property Tax Bill

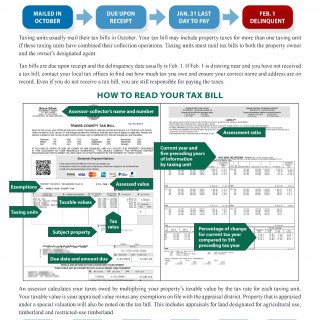

A Texas Property Tax Bill is an official documentation that provides details on the property taxes owed by a property owner in Texas. The purpose of this form is to inform property owners of the amount they owe in property taxes and provide them with instructions on how to pay their tax bill. The bill typically consists of several important fields, such as the property owner's name and address, the assessed value of the property, the tax rate, and the total amount due.

It may also include information on any penalties or interest that may apply if the payment is not made by the deadline. The parties involved in the tax bill are the property owner and the local government entity responsible for collecting property taxes, such as a county or city government.

a Texas Property Tax Bill is typically issued annually by the local taxing authority and is based on the assessed value of the property as determined by the county appraisal district. The bill may also include information on any exemptions or deductions that may apply to the property, such as homestead exemptions for primary residences.

The bill usually consists of multiple sections, such as a summary of the charges, a breakdown of the tax rate, and information on payment options and deadlines. The summary of charges section typically includes the total amount due, which may be broken down into separate categories such as city taxes, county taxes, school district taxes, and other special assessments.

The tax rate section provides information on how the tax rate is calculated, including any adjustments made by the local government entity. This section may also include information on any changes to the tax rate from the previous year.

The payment options and deadlines section typically includes instructions on how to make a payment, including online payment options, mail-in payments, and in-person payment options. It may also include information on any penalties or interest that may apply if the payment is not received by the deadline.

Overall, a Texas Property Tax Bill is an important document for property owners in Texas as it provides them with essential information on their property tax obligations and helps ensure that they stay current with their payments to avoid penalties and potential legal issues.