Form 01-137. Taxpayer Limited Power of Attorney

Form 01-137, Limited Power of Attorney, is a legal document used to grant an individual or entity the power to act on behalf of a taxpayer in specific tax matters. The primary purpose of this form is to authorize a representative to perform certain tasks and make decisions related to tax issues.

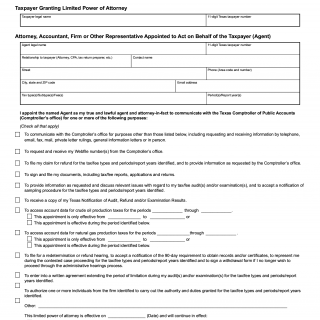

The form consists of several parts, including the taxpayer's identifying information, the representative's identifying information, and a description of the specific powers granted to the representative. Some important fields to consider when filling out the form include the taxpayer's name, address, and social security number, as well as the representative's name, address, and contact information.

The parties involved in the application process are the taxpayer who grants the limited power of attorney and the representative who is authorized to act on their behalf. It is important to carefully consider the powers granted to the representative and ensure that they are appropriate for the intended purpose.

Data required when filling out the form includes the taxpayer's identifying information, the representative's identifying information, and a detailed description of the specific powers being granted. No additional documents need to be attached to the form at the time of submission.

Examples and use cases for the Limited Power of Attorney form include authorizing a representative to handle specific tax matters, such as filing tax returns or responding to IRS inquiries. The form may also be used in situations where the taxpayer is unable to handle their tax affairs due to illness or other circumstances.

Strengths of the form include its ability to provide flexibility in allowing taxpayers to delegate certain tax-related tasks to qualified representatives. However, weaknesses may include potential risks associated with granting too broad of powers to the representative.

An alternative form that serves a similar purpose is Form 2848, Power of Attorney and Declaration of Representative. The primary difference between the two forms is the scope of the powers granted; Form 2848 allows for a broader range of representation than the Limited Power of Attorney form.

The form affects the future of participants by allowing them to delegate certain tax-related tasks to qualified representatives, which can help ensure compliance with tax laws and regulations. The form is typically submitted to the IRS or state tax agency and is stored in their records for future reference.