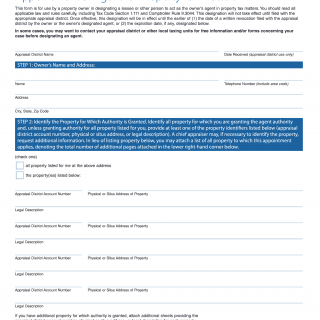

Form 50-162, Appointment of Agent for Property Tax Matters

The form 50-162, Appointment of Agent for Property Tax Matters, is a legal document used to appoint an agent to act on behalf of the property owner in property tax-related matters. The main purpose of this form is to designate a representative who can communicate with the appraisal district or collector's office regarding property tax issues.

This form consists of several important fields, including the name and contact information of the property owner, the name and contact information of the appointed agent, and the scope of authority granted to the agent. It is essential to provide accurate information when filling out this form to ensure that the appointed agent has the necessary authority to act on the property owner's behalf.

When filling out this form, the property owner will need to provide their name, address, and other personal information. Additionally, they will need to provide the name and contact information of the agent being appointed. No additional documents are required to be attached to this form.

Examples of situations where this form may be necessary include when the property owner is out of town, incapacitated, or otherwise unable to handle property tax matters themselves. This form allows them to designate someone they trust to handle these matters on their behalf.

Strengths of this form include providing a clear and legal means for property owners to appoint a trusted representative to handle property tax matters. However, weaknesses may include the potential for abuse by unscrupulous agents. Opportunities related to this form could involve expanding its use to other areas of property management or creating online versions for ease of use. Threats related to this form could involve changes in laws or regulations that limit the authority of appointed agents.

Related forms may include Power of Attorney forms, which allow individuals to grant broader powers of representation to another person. The key difference between these forms is that the Appointment of Agent for Property Tax Matters form only grants authority over property tax-related matters.

Once completed, this form must be submitted to the appropriate appraisal district or collector's office. It is typically stored in the property owner's file with that office.

Overall, the Appointment of Agent for Property Tax Matters form provides a legal and straightforward means for property owners to appoint someone they trust to handle property tax matters on their behalf.