Form AP-201. Texas Application for Sales Tax Permit and/or Use Tax Permit

The Texas Application for Sales Tax Permit and/or Use Tax Permit is a form used to apply for a permit that allows individuals or businesses to sell tangible personal property within the state of Texas. The main purpose of this form is to register for sales and use tax purposes.

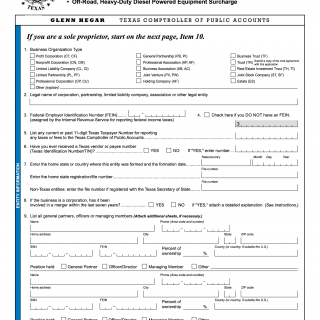

The form consists of several parts, including general information about the applicant, business details such as ownership information and type of business entity, and tax identification number. Some important fields to consider when filling out the form include the applicant's name and address, the type of business being operated, and the expected monthly sales.

The parties involved in the application process are the individual or business applying for the permit and the Texas Comptroller of Public Accounts who processes the application. It is important to consider all relevant information when filling out the form, as incomplete or inaccurate information may delay the processing of the application.

Data required when filling out the form includes business details such as the legal name of the entity, business address, and federal tax ID number. Additionally, applicants must provide information on their expected monthly sales and estimated taxable purchases.

No additional documents need to be attached to the form at the time of submission. However, applicants may be required to provide additional documentation during the review process.

Examples and use cases for the Texas Application for Sales Tax Permit and/or Use Tax Permit include starting a new business that sells tangible personal property in Texas, or expanding an existing business to include sales in the state.

Strengths of the form include its simplicity and its ability to easily register for sales and use tax purposes. However, weaknesses may include potential delays in processing due to incomplete or inaccurate information provided on the form.

An alternative form that serves a similar purpose is the Texas Online Tax Registration Application. The primary difference between the two forms is the method of submission; the Online Tax Registration Application is completed online, while the Application for Sales Tax Permit and/or Use Tax Permit is completed in paper format.

The form affects the future of participants by allowing them to legally sell tangible personal property within the state of Texas, while also ensuring compliance with state tax laws. The form is submitted to the Texas Comptroller of Public Accounts and is stored in their records for future reference.