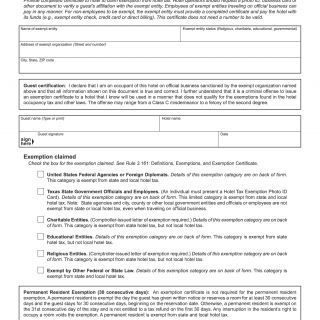

Form 12-302. Texas Hotel Occupancy Tax Exemption Certificate

The Texas Hotel Occupancy Tax Exemption Certificate, also known as Form 12-302, is a document used to claim exemption from state and local hotel occupancy taxes in the state of Texas. The form consists of several important fields that must be filled out accurately, including the name and address of the organization claiming the exemption, the reason for the exemption, and the signature of an authorized representative.

This form is typically used by organizations that are exempt from paying these taxes, such as government agencies, educational institutions, and certain non-profit organizations. When filling out the form, it is important to provide all required information and attach any necessary documentation, such as proof of tax-exempt status.

One important consideration when filling out this form is to ensure that the organization meets all eligibility requirements for the exemption. Failure to do so could result in penalties or other legal consequences. It is also important to note that this exemption only applies to state and local hotel occupancy taxes and not other taxes or fees that may be associated with a hotel stay.

Strengths of this form include its straightforward format and clear instructions for completion. However, weaknesses may include the potential for errors or omissions if the form is not carefully reviewed and completed.

Alternative forms or analogues to the Texas Hotel Occupancy Tax Exemption Certificate may include similar forms used in other states or jurisdictions, or other tax exemption forms for different types of taxes. Differences between these forms may include variations in eligibility requirements, required documentation, or deadlines for submission.

Submission of the form may vary depending on the specific jurisdiction or hotel in question, but it is typically submitted to the hotel at the time of check-in or check-out. It is important to keep a copy of the completed form for record-keeping purposes.

In summary, the Texas Hotel Occupancy Tax Exemption Certificate is an important document for organizations seeking to claim exemption from state and local hotel occupancy taxes in Texas. Careful attention to detail and compliance with eligibility requirements can help ensure a smooth and successful application process.