Form 50-114. Application for Residence Homestead Exemption (Texas)

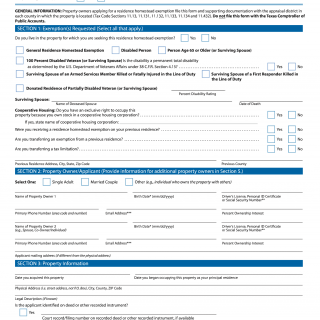

The Form 50-114 is an application for Residence Homestead Exemption that homeowners in Texas can use to request a reduction in their property taxes if they use the property as their primary residence. The main purpose of this form is to help eligible homeowners save money on their property taxes by claiming a homestead exemption.

The form consists of several parts, including personal information about the homeowner, details about the property, and information about any mortgage or liens on the property. Some of the important fields to consider when filling out this form include the owner's name and contact information, the property address, and any qualifying exemptions that may apply.

When filling out the Form 50-114, homeowners will need to provide certain data such as proof of residency, proof of ownership, and any relevant tax documents. In addition, they may need to attach additional documentation like a copy of their driver's license or voter registration card.

Examples of situations where this form would be necessary include when a homeowner purchases a new property, changes their primary residence, or experiences a change in their financial situation. By claiming a homestead exemption, homeowners can potentially save thousands of dollars on their property taxes each year.

Strengths of this form include its ability to help eligible homeowners save money on their property taxes, while weaknesses may include the complexity of the form and the need for additional documentation. Opportunities for improvement could include simplifying the form and providing more guidance to homeowners who need assistance.

Related forms may include other property tax exemptions or applications for tax abatements, while alternative forms could include applications for federal or state tax credits for home improvements or energy-efficient upgrades.

Filing this form can have a significant impact on the future of homeowners by reducing their property tax burden and making it more affordable to maintain their primary residence. The form can be submitted to the local county appraisal district or tax assessor-collector's office, and it is typically stored as a record of the homeowner's exemption status.