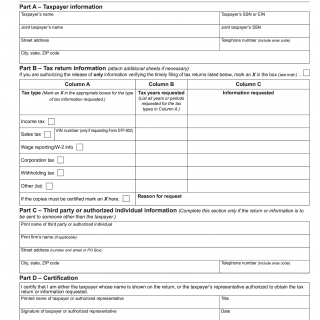

Form DTF-505. Authorization for Release of Photocopies of Tax Returns and/or Tax Information

DTF-505 is an authorization for the release of copies of tax returns and/or tax information. This form is used by individuals or entities who want to allow the New York State Department of Taxation and Finance (DTF) to release certain copies of their returns and/or tax information to a third party.

The form consists of three parts. Part one requires the taxpayer's contact information and a description of the documents they wish to release. In part two, the taxpayer must list all of the documents they wish to release in detail, including the type of document, the date, and the agency to which the tax information or return will be released. Part three requires the taxpayer to provide their signature and date. It is important to note that DTF-505 must be filled out entirely and correctly in order for DTF to accept it. The form must also be signed by the taxpayer if they want DTF to release any of their tax information or returns to a third party.

When filling out the form, the taxpayer must provide accurate information on the documents they are requesting to have released and make sure they are signed and dated. Attachments such as copies of returns, agreements, and letters of authorization should also be included. In addition, the taxpayer must also remember that any documents they submit to DTF may become public under certain legal proceedings and must be mailed or faxed to DTF.

The primary strength of the DTF-505 form is its ability to provide an accurate record of permissions for the release of copies of tax returns and/or tax information. This form enables the DTF to quickly and accurately process requests for tax information and keep track of the documents that have been released to third parties. It also ensures that the individual or entity releasing the documents is aware that the documents may become part of the public record and may be used in legal proceedings.

The primary weakness of the DTF-505 form is that it does not provide any specific information about the documents or data that the third party is allowed to access, beyond the document type, date, and agency to which the document will be released. This lack of detail could lead to misunderstandings or the release of incorrect or irrelevant documents.

In terms of opportunities and threats, the DTF-505 form presents few opportunities or threats. The primary advantage of using this form is that it provides a reliable and accurate record of the documents that have been released to third parties, which could be beneficial for legal proceedings. However, there is a potential risk that the documents released to the third party could be used in an unauthorized or unethical manner.

An alternative form that is similar to the DTF-505 is the IRS Authorization to Release Tax Information Form 4506T. This form is used to authorize the IRS to release tax information to a third party and also requires that the taxpayer provides a signature and date. However, the IRS authorization form requires additional information, such as the type of tax return or transcript, as well as the years that the taxpayer is requesting the release of documents for.

Overall, the DTF-505 form is an important tool for authorizing the release of tax returns and other tax information to third parties. It is important for taxpayers to remember to fill out the form completely and submit it with the necessary attachments in order for the DTF to accept it. Additionally, it is also important to be aware that any documents submitted to the DTF may become public record under legal proceedings.