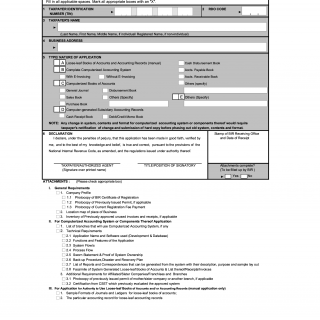

BIR Form 1900. Application for Authority to Use Computerized Accounting System

The BIR Form 1900 is an Application for Authority to Use Computerized Accounting System or Components thereof/Loose-Leaf Books of Accounts. The form is required to be completed by all taxpayers who wish to use either a Loose-Leaf or Computerized Books of Accounts and/or Accounting Records. The form should be filed with the Revenue District Office (RDO) having jurisdiction over the Head Office or branch before the actual use of the Books of Accounts and/or Accounting Records.

The main purpose of the form is to ensure that the taxpayer is authorized to use a computerized accounting system or loose-leaf books of accounts. The form consists of two parts: Part I - Taxpayer's Information and Part II - System/Software/Component Information.

Important fields to consider when writing the form include the taxpayer's name and address, tax identification number, type of business, and the type of accounting system or books of accounts to be used. Additionally, the form requires the taxpayer to attach supporting documents such as a sample printout of the accounting system or books of accounts to be used.

The parties involved in the form are the taxpayer and the Revenue District Office. It is important to note that the form is legally binding and failure to comply with the requirements could result in legal consequences.

Application examples and use cases for the BIR Form 1900 include small and medium-sized businesses who want to maintain accurate and up-to-date records of their financial transactions using computerized accounting systems or loose-leaf books of accounts.

Strengths of the form include its ability to ensure that taxpayers are compliant with the Bureau of Internal Revenue's requirements for maintaining accurate financial records. Weaknesses may include the potential for delays or complications in the approval process.

Alternative forms or analogues to the BIR Form 1900 include the BIR Form 1901 - Application for Registration for Self-Employed and Mixed-Income Individuals, Estates, and Trusts, and the BIR Form 1902 - Application for Registration for Individuals Earning Purely Compensation Income. However, these forms are specific to different tax-related purposes and differ in their requirements and obligations.

The form affects the future of the participants by ensuring that they are authorized to use a computerized accounting system or loose-leaf books of accounts, which can help them maintain accurate financial records and comply with tax regulations.

The form can be submitted to the Revenue District Office in person or by mail. It is stored in the taxpayer's records and may be subject to review by the Bureau of Internal Revenue.