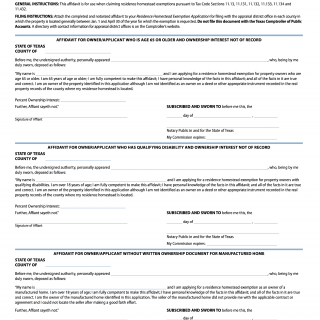

Form 50-114-A. Residence Homestead Exemption Affidavit (Texas)

Form 50-114-A is known as the Residence Homestead Exemption Affidavit, which serves as an application for homestead tax exemption in Texas. The primary purpose of this form is to provide homeowners with a reduction in their property taxes by declaring their residence as their primary homestead.

The form consists of several fields that need to be completed accurately, including the homeowner's personal information, property address, and details regarding any previous homestead exemptions claimed. It is crucial to fill in all the required fields correctly and attach any necessary supporting documents to avoid delays or denial of the application.

Parties involved in filling out Form 50-114-A include the homeowner and the local appraisal district, responsible for assessing the property value for tax purposes. A successful application will result in a lower property tax bill for the homeowner, saving them money each year.

This form is essential for anyone who owns a home in Texas and wishes to reduce their property tax obligation. It is also important to consider applying for this exemption when purchasing a new home.

One of the strengths of this form is its user-friendliness, making it easy for homeowners to apply for the exemption. However, a weakness could be the strict eligibility criteria that may prevent some homeowners from qualifying for the exemption.

Alternative forms or analogues to Form 50-114-A include various property tax exemption forms for other states. It is important to note that the eligibility criteria and process may vary depending on the state.

Once completed, the form can be submitted to the local appraisal district either via mail or in person. The form is stored electronically, and applicants can typically track the status of their application online.

Overall, completing Form 50-114-A is an important step for Texas homeowners looking to lower their property tax obligation. It is important to fill out the form accurately and attach any necessary supporting documents to ensure a successful application.