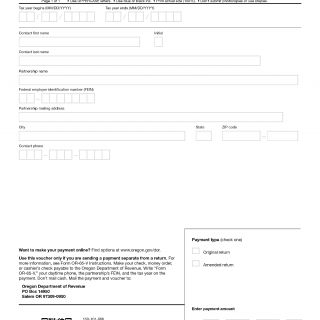

Form OR-65-V. Oregon Partnership Income Return Payment Voucher

Form OR-65-V is a compulsory tax form used by Oregon Partnership Income Return (PIR) filers. This form is used to make payments via electronic funds transfer (EFT) or by check. This form includes important fields such as the employers' Oregon employer identification number (EIN), Oregon estimated taxes to be paid, and the estimated total balance due, which are used to determine the amount of payment. It also includes information on the payer, such as the name, address, phone number, and type of payment. This form can be used for both electronically filed returns and check payments mailed by United States Postal Service extended services delivery (ESD). To complete the form, PIR filers will also need to attach necessary accompanying documents, such as an authorization agreement and a copy of a valid, government-issued photo ID.

The form OR-65-V benefits taxpayers by providing a secure, accurate, and easy-to-manage method for making estimated taxes. It also benefits the state of Oregon by helping them collect taxes efficiently. The form is also important for organizers because it can be used to maintain records and provide evidence of payment, which can be used when applying for future employment or benefits.

The strengths of the form OR-65-V are its accuracy and security. It helps ensure that taxes are properly collected and accounted for. The form is also easy to complete, and it can be electronically filed or mailed with additional documents. However, one potential weakness of the OR-65-V form is the difficulty of deciphering complicated instructions on the form, which can lead to errors in completing the form or missed deadlines.

This form can be filed with alternative forms such as OR-65 or OR-75, which are both used for filing Oregon estimated taxes. The main difference between the three forms is the type of payment accepted. OR-65-V is used for EFT and check payments, while OR-65 and OR-75 are used for electronic funds transfers only. The OR-65-V form is an important tool for filing taxes, and it can have a significant impact on the future of a PIR filer as it helps ensure taxes are paid in a timely and accurate manner.